Pressure Washing Business Professionals Keep Winning With Flexible Liability Insurance

Last Updated on August 7, 2023

Curious about how insurance can transform your pressure washing operations? Discover why successful power washing businesses swear by hourly basis, by the day, or one month coverage and how you can leverage it too.

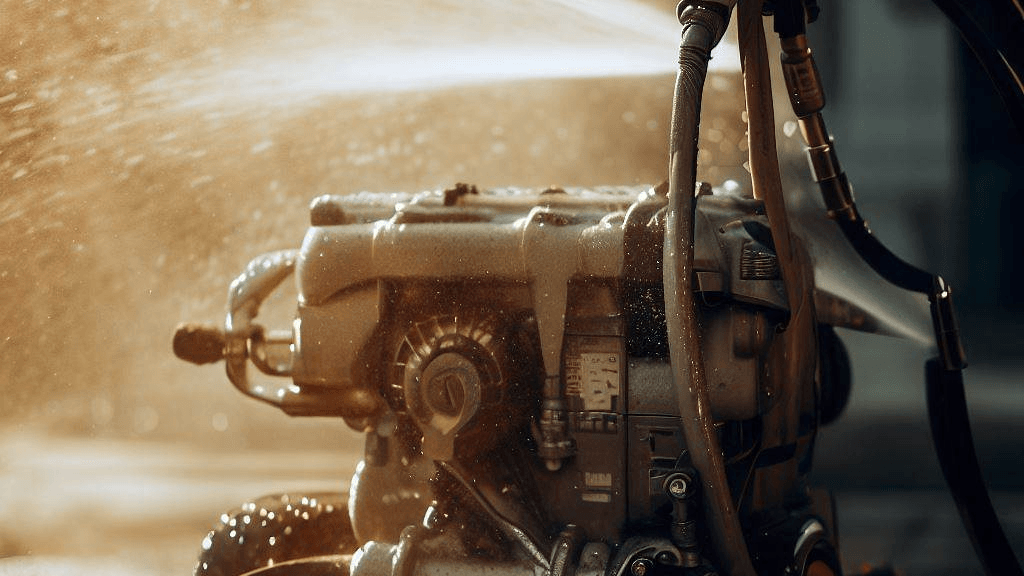

Picture this: You’re power washing a complex commercial exterior, your washer purring like a well-oiled machine. Suddenly, the hose buckles under intense pressure, sending a stray jet of water crashing through a nearby window. Without adequate insurance, this is a disaster, but with proper coverage, it’s merely a hiccup.

It’s this moment, right here, when you understand why your services needs an insurance plan. It’s as integral to your business as the unloader valve is to your pressure washer. In the same way the valve regulates and redirects excess pressure to prevent damage to your machine, a comprehensive insurance plan helps manage potential financial risks to your business. It’s a safeguard that enables your enterprise to withstand unforeseen events and keep running smoothly.

Matching Insurance to Your Pressure Washing Jobs

That said, all pressure washing services are not created equal. Different jobs entail different risks. What works for a small residential cleaning job might fall short for a commercial project or a month-long industrial contract. Hence, your insurance needs to fit your business like a well-tailored suit. It’s why the flexibility of hourly, daily, or monthly insurance coverage is something to consider seriously.

But why? Let’s delve a little deeper. Imagine you’re about to take on a huge commercial project – a skyscraper clad in years of grime and pollution. It’s akin to facing a heavyweight boxer. You wouldn’t step into the ring without adequate padding and protection, would you? Similarly, taking on such a mammoth power washing task without robust coverage for the day or the entire duration of the project could leave you vulnerable.

But what about those routine residential jobs, which are more like friendly sparring sessions than aggressive boxing matches? With such tasks, you might not need the full-blown, heavyweight protection, but a lighter ‘by the hour’ safeguard. This flexibility can be a real game-changer, ensuring you have the right coverage for each unique job—no more, no less.

Adapts to Your Schedule: The Power By The Hour Approach

Imagine a scenario: your power washing business has a major job scheduled—an extensive commercial property that will likely take several hours to complete. Instead of paying for one day or month of coverage, an hourly plan allows you to adjust your policy for the specific timeframe of that job. You don’t have to worry about overspending on coverage you don’t need, much like you wouldn’t leave your power washer running when it’s not in use.

Hourly insurance is akin to the precision of a well-aimed power wash nozzle—it targets exactly what you need when you need it, providing a lean yet robust protective shield. By opting for hourly coverage, you streamline your expenses and apply a powerful jet of efficiency to your operations.

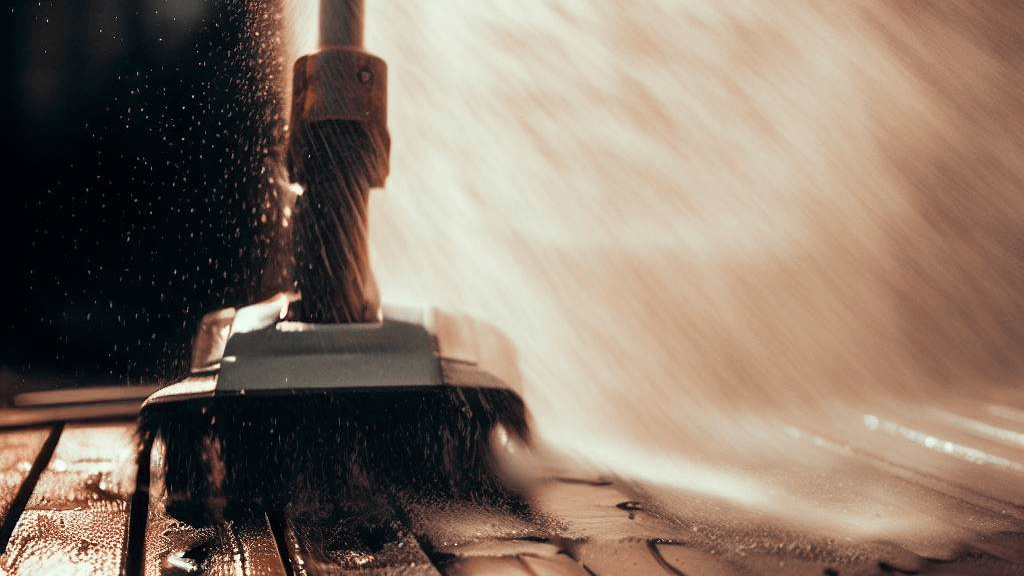

Daily Insurance: More than a 24-Hour Safety Net

Consider the instances when your power washing service is hired for a full-day project, or maybe a series of residential jobs in one day. This is where daily insurance plans shine, acting as a heavy-duty, comprehensive safeguard, much like the reliable high-pressure hose that stands up to a day’s rigorous use without faltering.

These policies are designed to cover more intensive work schedules without the long-term commitment of a monthly plan. They act as a safety harness, holding your business secure against the high wall of liability risks that might be associated with a day’s hard work.

A Month of Protection: Your Business Armor

There are times when your calendar is packed, and you’re facing weeks of back-to-back projects. That’s when a monthly insurance plan makes more sense than an hour or daily timeframe, serving as your business’s sturdy protective gear, much like the resilient outerwear that shields you from the splash-back of your pressure washing tasks.

A monthly policy provides an extended safety net, buffering your business against the roller coaster of risks that come with a busy schedule. It’s a smart choice for high season or peak services periods when jobs are lined up like dominoes, and you can’t afford a single one to fall unexpectedly.

Getting to Know Your Coverage: The ABCs of Pressure Washing Insurance

Let’s break down the different types of insurance that a pressure washing service should consider:

- General Liability Insurance: This is your primary line of defense against third-party claims of bodily injury, property damage, and personal and advertising injury. Say, for instance, your pressure washer accidentally damages a client’s property, or a passerby slips and falls on a wet surface caused by your work—general liability insurance got you covered.

- Commercial Property Insurance: If you have a physical office or store for your power washing business, commercial property insurance is crucial. It helps cover the cost of damages to your property, like your office or storage facility, due to events like fire, theft, or natural disasters.

- Commercial Auto Insurance: When your business owns vehicles, this insurance is vital. It covers damages to your business vehicles or liabilities resulting from an accident while performing daily business-related activities.

- Workers Compensation Insurance: This coverage is essential if you have employees. It pays for medical expenses and lost wages if a worker gets injured or ill while performing their job duties.

- Professional Liability Insurance: Also known as Errors & Omissions insurance, this covers claims arising from advice or services you provide. If a client claims that the work done or advice given led to financial loss, this policy has your back.

- Inland Marine Insurance: A must-have if you transport your pressure washing equipment to various job sites. It helps cover the cost if your equipment gets damaged one day or lost in transit.

Each of these policies plays a unique role in protecting your pressure washing service from potential financial pitfalls. So it’s vital to evaluate your needs and understand what each policy offers before purchasing insurance by the hour, daily, or monthly.

A Balancing Act: Understanding Pressure Washing Insurance Costs

The cost of pressure washing insurance can vary widely based on multiple factors. Think of it like the pressure setting on your washing machine: just as different jobs require different pressure levels, different businesses have different insurance needs, leading to varying costs.

General liability insurance may be the most significant expense, given its broad coverage. But the exact cost can depend on factors like your location, the types of services you offer, your business’s size, and your claims history. Workers compensation insurance, another significant cost, depends on factors like the number of employees and their occupational risk.

But remember, expensive doesn’t always mean unnecessary. Like a high-pressure wash that blasts off stubborn grime, sometimes you need to invest a bit more to ensure adequate protection.

Navigating Legal Obligations and the Power of Choice

As a power washing pro, you have legal obligations to meet. Workers compensation insurance is typically required by law if you have employees. Without it, you could face fines, lawsuits, or even criminal charges. Similarly, if your enterprise owns vehicles, most states require some form of commercial auto insurance.

And then there’s the choice between purchasing insurance directly from a provider or using an insurance broker. Going direct can sometimes save you money, as you’re not paying a middleman. But brokers offer a valuable service, helping you compare quotes and coverage from multiple insurers to find the best fit for your needs. Think of them as the detergent in your power washing operation – they help make the process smoother and more effective.

Securing Continuity: The Importance of Business Interruption Insurance

Unexpected events can cause a significant disruption to your operations. For instance, a fire could damage your office, or a crucial piece of equipment could break down, resulting in downtime. This is where business interruption insurance comes into play.

Much like a reserve tank ensures continuous water supply during your pressure washing operation, business interruption insurance provides coverage for lost income during these unforeseen disruptions. It helps you maintain financial stability until you can return to normal operations.

While it might seem like an extra cost, consider the potential financial impact if you couldn’t operate for days or even weeks. That ‘extra’ could quickly become essential.

Becoming a Master: The Buying and Claim Process

Understanding how to navigate the insurance buying process is much like mastering the controls on your pressure washer: with knowledge and practice, it becomes second nature. It starts with identifying your needs, followed by comparing quotes from different insurance providers or working with a broker.

Once you’ve chosen a policy and provider, it’s time to finalize the paperwork. Ensure you understand all the terms and conditions before signing up. Remember, it’s not just about cost but also about having the right coverage to protect your business effectively.

The claim process is another crucial aspect. Knowing what to do when an accident happens can expedite the settlement process. Whether it’s property damage or a bodily injury claim, reporting it promptly and providing accurate information is key.

The Pressure Washing Business and its Challenges

Every pressure washing service, from residential to commercial, faces a unique set of challenges. From managing customer expectations to ensuring the safety of employees and clients, pressure washing professionals have to navigate a myriad of risks every hour of the day.

Risks, however, are part of the industry landscape, just as the pressure washing contractors are part of the broader cleaning industry. These risks can include damaging property, accidental injuries at the job site, or equipment theft. The consequences can range from minor disruptions to substantial financial loss and legal liabilities. For instance, a power washer used incorrectly can result in substantial property damage or personal injury.

Addressing Common Liability Risks

So, how do you handle these risks? It’s all about being proactive. Training your employees, establishing safety protocols, ensuring proper equipment maintenance, and purchasing insurance for pressure washing are all crucial steps.

Just as you wouldn’t operate a pressure washer without understanding its components and safety features, you shouldn’t run a business without understanding its inherent risks and how to mitigate them. One of the best ways to do this is through comprehensive insurance coverage.

Building Confidence with Robust Insurance

Remember, running a successful pressure washing service isn’t just about acquiring the best equipment or offering a wide range of services. It’s about building a solid business foundation that includes robust insurance coverage. A strong insurance policy doesn’t just offer financial protection—it also lends credibility to your business, making clients more confident in hiring your services.

A Powerful Symbol of Client Dedication

Your insurance policy is more than a safety net—it’s a testament to your commitment to your clients, your employees, and your business. It demonstrates your willingness to protect your business from unforeseen events and financial losses. It shows your dedication to your clients’ safety and satisfaction.

A well-chosen insurance policy can be the difference between a minor setback and a significant financial loss. It’s about peace of mind, knowing that you’re covered no matter what happens.

The Final Rinse: Ensuring the Best Protection

Choosing insurance for your pressure washing business isn’t just about meeting legal requirements; it’s about safeguarding your business’s future. Just as you would maintain your pressure washing equipment regularly, your insurance policy needs regular review too. As your services grow, your insurance needs will evolve as well.

When it comes to insurance, more isn’t always better. It’s about having the right coverage. You wouldn’t use a turbo nozzle to clean a delicate surface – the same logic applies to insurance. Over-insuring can lead to unnecessary costs, while under-insuring leaves you vulnerable.

Lastly, don’t forget to look at the insurer’s reputation and financial stability. Just as you would only buy a pressure washer from a reliable manufacturer, choose an insurance company with a solid track record.

Closing Thoughts: Insurance for Power Washing Businesses

Every pressure washing professional knows the importance of routine maintenance to keep their equipment performing optimally. Think of insurance in the same way. It’s the routine maintenance that keeps your business running smoothly, absorbing the shocks of unexpected events, and offering you peace of mind.

So, are you ready to safeguard your pressure washing operation with the right insurance coverage? Whether it’s general liability insurance, workers compensation, commercial auto, or something else, remember: your insurance policy is your business’s unloader valve. Let it manage the pressure so you can focus on what you do best – delivering sparkling clean surfaces to your customers.

It begins with one step: Get a free quote online for an hour, one day, or even one month of coverage. Explore your options. Don’t settle for the first quote you get. Consult with multiple insurers, compare quotes, and understand the policy. Ensure you’re getting the best coverage for your investment. After all, your pressure washing business deserves nothing less than the best protection.