Polish Your Plan!: A Guide to Your Nail Salon Insurance Needs

Last Updated on December 26, 2022

Running a nail salon is an endeavor that is as elaborate as the nail designs you create. This is true from opening your shop to protecting your operations so your services are always available for your clients.

With that said, your specific business comes with its own set of risks and potential liabilities. From chemical exposure to slips and falls, it becomes important for you to have the right insurance coverage in place to protect yourself as the owner and your business from having to pay out expenses relating to accidents and mistakes in your activities.

That is why, in this article, we’ll discuss the types of insurance policies available for nail salons, insurers from whom you can get these, and everything else you need to polish your plans for protecting your beloved enterprise.

Table of Contents

Why do nail salons need insurance?

What types of insurance coverage should nail salons have?

How much does nail salon insurance cost?

What are some of the best providers of insurance for nail salons?

The Bottom Line

Why do nail salons need insurance?

As a nail salon owner, you want to ensure that your business is protected from mishaps. This can include coverage for property damage at your salon, health-related harm to clients or employees, and professional liability in case any of your technicians make a mistake during service. These occur more often than you would think. Additionally, some states may require certain types of insurance coverage for nail salons to obtain operating licenses.

And depending on the insurance policies you have, your nail salon could be safeguarded from almost any risk you may encounter, from natural disasters and theft to injuries, lawsuits, and advertising mistakes. This is why it’s important for nail salons of any size to be covered.

In the next section, we outline what particular types of insurance coverage your nail salon will need and how these will be able to protect you.

What types of insurance coverage should nail salons have?

The specific coverage needed will vary depending on the size and services offered at your salon. However, some common coverage options include:

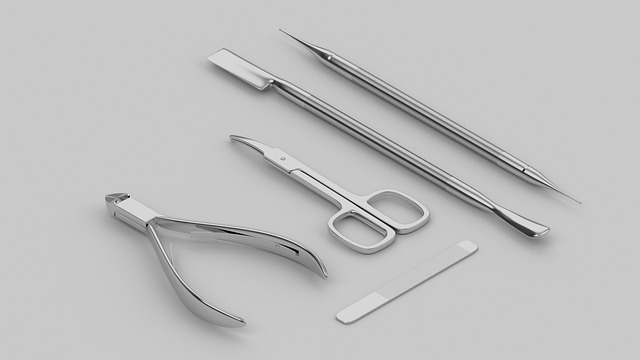

General liability insurance. This will protect against accidents or injuries that occur at your salon, specifically, to visitors and clients. Some of the most common health hazards in salons are cuts, gashes, and wounds from the use of nail cutters and cuticle nippers, for instance, exposure to chemical hazards that pose a risk to people’s health, and ergonomic risks as customers often have to stay still for a long period or position their body in such a way that causes them discomfort.

Your general liability insurance will also cover property damage and injury cover damage and advertising injury to any third party. Should a technician spill polish on a customer’s phone, this policy could help pay for repair or replacement. It will also save you from expensive legal fees in the event that someone sues you for copyright infringement, violation of privacy, libel, and other issues that may be caused by your company’s advertising.

Workers’ compensation insurance. On the other hand, workers’ comp is a specific type of coverage that looks after the welfare of your nail techs, salon managers, and other employees.

Workers’ compensation insurance will cover medical expenses and lost wages for your employees in case they are injured or become sick on the job. This type of coverage is often required by state laws and, in the case of nail salons, protects your workers given they are exposed to multiple biological hazards such as infected flesh and constant inhalation of carcinogens.

Professional liability insurance. This coverage, also known as “errors and omissions” insurance, will protect your business from any mistakes made by your technicians while servicing clients. As they are trained and considered experts in anything nail-related. Their mistakes can range from something as small as a chipped nail to an infection caused by improper sterilization of instruments.

If the mistake results in a lawsuit, your professional liability insurance can cover legal fees and settlement costs.

If your salon offers additional products, such as waxing or eyelash extensions, the above coverages could also come in handy for these specific services.

Business or commercial property insurance. This policy will protect your salon’s property, such as equipment and furnishings, against incidents like theft, vandalism, fire damage, and other natural disasters.

Product liability insurance. In a nail salon, product liability insurance will cover any damage caused by the products used on clients. This includes nail polish, nail glue, acrylics, lotions, and other skin or hair care products.

Should a client experience an allergic reaction to a product or suffer from long-term health effects as a result of its use in your salon, product liability insurance can cover the resulting expenses and legal fees.

Business interruption insurance. This type of coverage can provide income if your salon has to temporarily shut down due to a covered incident, such as a natural event or equipment malfunction. It can also cover expenses like temporary relocation and employee salary during the interruption period.

In addition to the above coverages, it’s also important for nail salons to consider additional coverage options such as cyber liability insurance (to protect against data breaches) and employment practices liability insurance (to protect against discrimination and harassment claims).

Finding the right insurance coverage for your nail salon can seem overwhelming, but it is important to have the peace of mind of knowing that your business is protected.

Consider speaking with a licensed insurance agent to discuss your unique needs and what coverage options are available for your salon. It’s always better to be safe than sorry.

How much does nail salon insurance cost?

The cost of insurance for a nail salon will vary depending on factors such as the size and number of employees, the services offered, the location, claims history, and the amount and type of coverage chosen. Generally speaking, most small businesses can expect to pay anywhere from $500 to $3,000 per year for their insurance needs.

However, the best way to get an accurate quote is to speak with a licensed insurance agent as this will also help you find a policy that fits both your budget and level of protection. After all, it is always important to remember that the cost of not being insured can far outweigh the expense of having proper coverage in place.

What are some of the best providers of insurance for nail salons?

It’s worth shopping around and comparing policies from multiple insurers to find the best fit for your specific business needs. Additionally, many insurers have specific programs or packages tailored toward small businesses in the beauty industry.

Some top insurance companies that offer coverage for nail salons include Huckleberry, Hiscox, SimplyBusiness, biBERK, THREE, and Thimble.

Huckleberry

Huckleberry’s nail salon insurance recommends a business owners’ policy or BOP for owners. This includes general liability, professional liability, and business interruption in one policy, starting at $42 a month or $500 annually, and would be useful whether you are a home-based tech or an owner of a large shop.

Additionally, they also offer workers’ compensation insurance for which they provide a calculator so you could easily gauge how much you would pay depending on your state and the number of your employees.

Huckleberry is an insurance brokerage opened in 2017 that offers free online quotes, live chat support, and uses technology to deliver instant responses to client inquiries.

Hiscox

Hiscox offers insurance policies for salon owners, nail technicians, and cosmetologists in general. They offer both online and offline support as they are a large company with offices across the states and thousands of employees to assist their clients.

They are a longstanding player in the insurance industry and offer tailored policies for almost every profession imaginable, along with other resources for choosing the right coverage and even growing your enterprise.

A general liability policy from Hiscox will start at $30 monthly or $350 annually. If your business is already growing and delivers services beyond nail care, you may want to go with Hiscox.

SimplyBusiness

SimplyBusiness offers insurance to salons of any size, whether your shop is located on a busy street and houses multiple clients and workers daily or you’re a home-based tech that visits clients or has them over for appointments.

As do the other companies, SimplyBusiness offers online quotes from multiple insurance providers and you could expect to pay $50 monthly for a policy including general liability, workers comp, and commercial property insurance.

biBERK

biBERK is a direct insurance provider under the Berkshire Hathaway Group and was specifically developed in 2015 to help small businesses. They offer key coverages such as the ones mentioned above, along with umbrella insurance for extra coverage should your policy limits not be able to cover your claims.

The company offers both online and offline support for clients and could save you up to 20% on your insurance as they do not involve a broker.

THREE

THREE includes nail salons in its roster of industries for which they provide “The Policy”.

“The Policy” from three is a jargon-free, three-page document that allows small business owners to combine all the insurance coverages they need in a single policy. These could include all the coverages you need for liability, business interruption, cyber security, worker’s compensation, auto, and property insurance.

THREE is also a Berkshire Hathaway company and has insurance experts on call to help clients craft “The Policy” for their specific needs.

NEXT

NEXT offers insurance packages for a vast array of beauty-related enterprises and professions including nail technicians, beauticians, and salon owners. Their insurance packages range from basic to pro plus with varying coverage limits and suggested coverages for your specific business type.

You can get nail tech insurance from NEXT for as low as $8 a month, with the added perk of their mobile app from where you can manage your policy at any time and anywhere.

Thimble

Thimble is a provider of on-demand insurance and sells insurance policies to beauticians and cosmetologists including nail artists and techs. Like NEXT insurance, they too have a mobile app for customers’ ease of use and offer online quotes for their potential clients.

Thimble is a good option for nail techs who make designs as a side hustle and are among the cheapest options for providers as their policies start at $17 a month.

The Bottom Line

There is no one best provider for nail salon insurance as the needs of each business vary. It’s always a smart move to compare policies, coverage options, and prices from multiple insurers to find the best fit for your specific business.