Tailored Coverage for Unique Risks: NEXT Insurance vs Thimble vs InsuranceBee

Last Updated on March 7, 2023

Businesses face different risks, and as such, need different types of insurance coverage. A company that predominantly operates in an industry with greater risks will need to purchase higher limits of liability insurance than one with low risk. But, what if your business has unique risks that are not easily categorized? In this case, you may need to get tailored insurance coverage to properly protect your business.

If you’re in the market for unique insurance coverage, you might be wondering about the pros and cons of NEXT, Thimble, and InsuranceBee. All three companies offer tailored insurance policies, but which one is right for you?

In this article, we will provide an extensive analysis of each company, their coverages, and what they specialize in so that you can make a more informed decision.

Table of Contents

Considerations When Choosing a Provider

Company Descriptions

NEXT

Thimble

InsuranceBee

Coverages Offered

Online and Offline Support Availability

How Much Insurance Policies Cost

Pros and Cons of Each Company

The Bottom Line

Considerations When Choosing a Provider

There are a few things you need to keep in mind when shopping for unique insurance coverage. First, you need to make sure that the company you’re considering is licensed in your state. Each state has its own requirements for insurance companies, so you’ll want to make sure the company you’re considering is recognized and authorized.

Second, you need to make sure the company is reputable. You can check with the Better Business Bureau or other consumer protection organizations to see if there have been any complaints filed against the company.

Third, you need to make sure the company offers the coverage you need. Not all companies offer the same coverages, so it’s important to find one that offers what you need.

Company Descriptions

Before moving on to comparisons, here’s a quick rundown of each company:

NEXT

NEXT Insurance, based in Palo Alto, California and founded in 2015, offers digital insurance policies specifically for small businesses. They provide quick quotes and competitive pricing on all of their tailored policies.

NEXT Insurance, based in Palo Alto, California and founded in 2015, offers digital insurance policies specifically for small businesses. They provide quick quotes and competitive pricing on all of their tailored policies.

The company uses technology and machine learning to speed up the insurance process by letting clients bundle coverages, pay for premiums, and manage policies online.

Thimble

Jay Bregman and Eugene Hertz founded Thimble in 2016 as a company that provides insurance for drones. At present, they are headquartered in New York City and offer on-demand insurance for any length of time that small business owners need it – whether that’s for a day, month, or year.

Thimble is all about simple and fast-moving insurance so that you can purchase the coverage you need without any fuss.

InsuranceBee

InsuranceBee is a service started in 2010 focused on providing coverage for independent contractors, freelancers, LLCs, sole proprietorships, subcontractors, and the self-employed.

As such, they focus on professional liability insurance, errors and omissions insurance, and even directors’ and officers’ insurance.

Coverages Offered Across The Three Companies

Here, as we move on to comparisons, we start with the key policies that are common to NEXT, Thimble, and InsuranceBee:

General Liability Insurance: If you want to be safe from potential lawsuits involving property damage or injury, then you need general liability insurance.

Professional Liability Insurance: Professional liability insurance, also known as errors and omissions coverage, can cover your legal defense expenses and damages from allegations of negligence or mistakes even if the claims are unfounded.

Business Owners’ Policy: A business owners’ policy (BOP) is a type of insurance that offers protection for small businesses from general liability and their properties from damage or loss.

Workers’ Compensation Insurance: If an employee falls ill or gets hurt while working, workers’ compensation insurance can cover their medical bills and lost wages. Additionally, it acts as a shield for employers from lawsuits because it can settle legal costs.

Property Insurance: Also known as commercial property insurance, this can cover any physical property that your business owns, such as buildings, equipment, inventory, and furniture. This is offered by InsuranceBee as business personal property insurance and is an add-on to general liability insurance.

Coverages Only Offered by One Company

Now, this is where the insurance services first diverge. Here, we detail coverages that are unique to one company and ones that you may be specifically looking for for your operations:

Coverages Only Offered by NEXT

Commercial Auto Insurance: This covers towing, collisions, as well as injuries and property damage caused by vehicles your company owns.

Hired and Non-owned Auto Insurance: This type of coverage protects businesses that use vehicles owned by employees or rented for work-related purposes.

Product Liability Insurance: Product liability insurance can protect your business from damages and legal expenses that may arise from injuries or property damage caused by products sold by your enterprise.

Coverages Only Offered by Thimble

Drone Insurance: This is the firm’s first policy, which protects both the aircraft and the owner against claims related to damage, unintentional injury, and other dangers.

Coverages Only Offered by InsuranceBee

Management Liability Insurance: Management liability insurance is simply the name given to a collection of insurance policies that includes fiduciary liability insurance, employment practices liability insurance, and directors’ and officers’ insurance.

Fiduciary Liability Insurance: A fiduciary liability insurance policy, FLIP for short, protects individuals from lawsuits alleging breach of duty.

Employment Practices Liability Insurance: Employment practices liability insurance can pay for the damages of an employment-related dispute such as wrongful termination or discrimination.

Directors’ and Officers Insurance: This policy can help protect your directors and officers from personal financial damages if they’re sued for wrongful decisions or actions while in their corporate roles.

Cyber Insurance: This policy can help your business recover from cybercrime and data breaches, as well as the costs of notifying customers of the incident.

Online and Offline Support Availability

The next thing you may consider apart from the types of coverage offered is how well they would be able to deliver on their services beyond selling you policies. This can be measured by looking at the availability of online and offline support channels from each company as business owners have different preferences when it comes to communicating with their insurers.

NEXT Support

Before anything, NEXT refers clients to their help center when they have any queries. Here, you can enter a question and find an article that has the answer for you.

And if you do not find the answer in the help center, NEXT features a live chat available from Mondays to Fridays from 8 a.m-5 p.m. CT. During these times, their insurance team is online for both insurance advice and assistance.

Photo Credit: nextinsurance.com

NEXT also has a mobile application that allows you to manage your insurance policy, obtain a certificate of insurance (COI), update your coverage if necessary, and file a claim.

Thimble Support

Thimble offers customers an online Help Center, live chat assistance Monday through Friday 9 a.m. to 6 p.m. EST, and an email contact form to express concerns and reach a specialist, much like NEXT.

Photo Credit: Thimble Insurance

They too have an app where you can buy a policy, get a quote, get proof of insurance, and pay for your insurance–all within seconds.

InsuranceBee Support

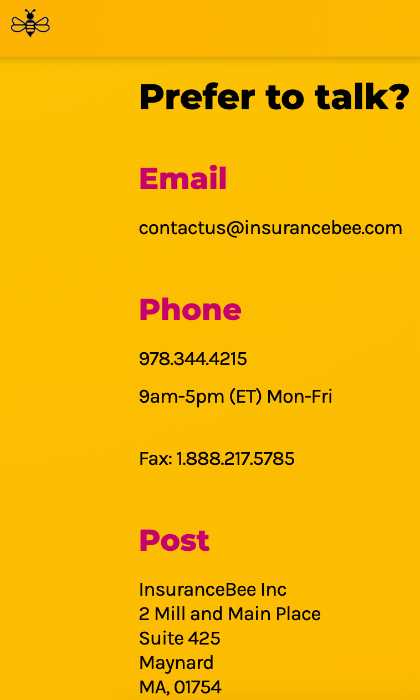

InsuranceBee combines online and offline channels for customer support. You can email them at contactus@insurancebee.com or call them at 978-344-4215 from Mondays-Fridays at 9 a.m.-5 p.m. ET.

If you need to send in more paperwork, they also leave a mailing address so you could snail mail them instead.

How Much Insurance Policies Cost

Of course, more specialized needs such as product liability will cause rates to increase from any insurance provider, as will other factors such as your claims history, number of employees, and business type, among others.

However, we can compare the general costs of the insurance companies by looking at the price of their professional liability insurance. From NEXT, this policy can cost as little as $18.34 a month or roughly $220 a year, while the price starts at $45 a month or $500 a year for Thimble. Lastly, InsuranceBee will offer an annual premium of $400 for the same insurance.

With this, we know that NEXT offers the best price for professional liability insurance and Thimble is the most expensive.

Pros and Cons of Each Company

NEXT Insurance offers tailored coverage and is better suited for companies with physical store locations or have physical operations in general. If you are an owner of a beauty salon, offer cleaning services, are a personal trainer, or a handyman, NEXT’s select options could benefit you. They offer specific coverages such as liquor and product liability and protection for vehicles whether or not they are owned by the company. Among the three, the company’s policies are also the least expensive. Learn more about this powerhouse insurer in this thorough Next business insurance review we compiled.

Meanwhile, Thimble is a good choice for those who want an insurance company that is easily reachable and offers fast customer service. If you’re involved in events such as in being an organizer, entertainer, vendor, photographer, or videographer that needs tailored insurance for that one day or few days you need it most, Thimble has got your back. However, you’ll find in our Thimble insurance review that the company’s rates may be more expensive for some small businesses.

InsuranceBee has lower rates than Thimble for professional liability insurance because this is where they specialize. However, they do not have a mobile app like the other two companies. Our full Insurancebee review leaves no stone unturned.

True to their slogan “Liability insurance with a personal touch” InsuranceBee offers multiple channels for customer support through which their cordial agents could assist you with anything insurance-related. If you are someone who regularly takes on contracts and is at risk of clients complaining about your job, a freelancer who stores sensitive customer information when doing gigs, or simply self-employed who has valuable equipment to protect, InsuranceBee offers the coverage you need.

As an aside honorable mention candidate, read our complete THREE insurance review breakdown.

The Bottom Line

NEXT Insurance, Thimble, and InsuranceBee are all good choices for small business insurance and each has its specialty. Your decision may come down to price, the type of customer support you need, what coverage you’re looking for, and when you’re looking to have it.

NEXT has the most competitive rates while Thimble offers fast and convenient customer service. InsuranceBee combines online and offline support channels to deliver a more personal touch.

Thank you for reading and we hope that you found this article helpful in contrasting the three!