GEICO Small Business Insurance Review

Last Updated on January 19, 2023

The insurance industry takes a big hit during financial crises, as many people either can’t or don’t want to keep up with premium payments.

However, while these crises present difficulties for existing consumers, they also create new business opportunities for insurers. More individuals look to buy products that will help reduce risk and provide protection during difficult times. As such, financial crises usually lead to growth in the industry because of these increased sales.

Over the years, we have seen numerous financial crises around the world, from the Asian Crisis of 1977 to the global financial meltdown of 2008. While recent events have been difficult for insurance companies protecting individual entities, they too have created opportunities in new markets.

In the wake of these crises, GEICO has positioned itself as a leader in insurance for vehicles, homeowners, renters, and businesses. Established in 1936 amid the Great Depression, the company has only seen growth, especially with their policies-in-force (PIFs) increasing by millions every few years.

Today, we specifically dive into GEICO’s business insurance product portfolio, discussing how they could benefit small businesses such as yours, how they compare to other insurers’ offerings, their costs and pricing factors, and even the potential drawbacks of this company (if any), to help you make an informed decision in deciding to purchase a policy.

Table of Contents

Beyond Economic Recessions: The Importance of Insurance for Small Businesses

GEICO Business Insurance Coverages

The Availability of Coverage Options from GEICO

Advantages of a Business Owners’ Policy

Why Do Small Businesses in the Wellness and Fitness Industry Need Medical Malpractice Insurance?

GEICO Policy Cost and Pricing Factors

Getting a Quote

GEICO Small Business Insurance Rating

How to Make a Claim with GEICO

3 Alternatives to GEICO

Bottom Line

FAQs

Beyond Economic Recessions: The Importance of Insurance for Small Businesses

According to the US Small Business Administration, about half of the number of small businesses do not survive past their first five years. While small businesses may not be exempt from market crashes, what you should really be on the lookout for are manageable risks. These are more likely to cause an unanticipated closure.

More often than not, business failures are the result of a lack of planning and organization – be that in terms of growth or team management. Of course, sometimes things happen that are out of your control–like accidents, theft, or natural disasters. That’s where having a great business insurance policy comes in handy. Before you start planning any other part of your business strategy, be sure to factor in financial strength and security.

Insurance protects small businesses against risks such as property damage or lawsuits from clients and employees. It can also serve as a safety net to help keep your business afloat during difficult times, like the current COVID-19 pandemic that has forced many businesses to temporarily close or scale back operations.

To this end, whether you’re operating a retail store or providing services online, having reliable coverage helps you safeguard your reputation and investments for the long term.

GEICO Business Insurance Coverages

As part of GEICO’s comprehensive business insurance portfolio, their offerings include the following coverages for small businesses:

Business Owners’ Policy: This combines liability and business furniture and equipment coverage in a single policy. As such, this will cover defense costs, medical expenses for third-party bodily injury, and repair or replacements for damaged property.

Professional Liability Insurance: Also called Errors & Omissions or E&O insurance, this provides professionals protection from claims relating to mistakes, poor advice, and even uncompleted services.

Cyber Liability Insurance: This protects small businesses from malware, ransomware, phishing, and other cyber-related attacks. Protection from cyber liability is essential for small businesses offering professional services since sensitive client information is often involved in these transactions.

General Liability Insurance: As the name suggests, a commercial general liability policy covers the general risks associated with daily small business operations such as liability for physical injury and property damage.

Workers’ Compensation: Perhaps the only mandatory form of coverage in most states, this ensures that your employees can pay out expenses for medical treatment and are compensated for lost wages during rehabilitation or recovery.

Medical Malpractice: This covers medical professionals including nurses, doctors, and even yoga instructors and personal trainers who are at risk of negligence claims and damage to their reputation as a healthcare provider.

Commercial Auto Insurance: Business auto insurance covers vehicles owned and operated by your business, including trucks and company cars.

The Availability of Coverage Options from GEICO

As seen above, GEICO offers commercial insurance for a variety of industries such as retail, professional services, and hospitality. These are available in all 50 states. GEICO even has offices in overseas locations such as Belgium, Germany, Italy, Spain, and the United Kingdom.

Advantages of a Business Owners’ Policy

There are many advantages to having a Business Owners’ Policy, or BOP. These are among the offerings of GEICO.

Firstly, a BOP offers comprehensive coverage for your business activities and assets. Whether you conduct your business from an office, storefront, or factory, a BOP will keep you protected no matter what types of risks you face daily.

Additionally, because BOPs are bundled packages that include multiple policies, they can often offer significant savings compared to the cost of purchasing each policy individually.

Beyond cost and coverage considerations, another important benefit of having a BOP is that it provides professional risk management advice tailored specifically to your business needs. With expert guidance and support from your insurance provider such as GEICO, you can rest assured that you’re well-prepared to weather any challenges and seize new opportunities as they arise.

Overall, a Business Owners’ Policy is a key component for protecting your business interests and ensuring its long-term success.

Why Do Small Businesses in the Wellness and Fitness Industry Need Medical Malpractice Insurance?

Small businesses in the wellness and fitness industry play an important role in promoting healthy lifestyles and helping individuals reach their goals. Whether it’s a yoga studio, nutrition counseling service, or personal training studio, these businesses provide valuable support and expertise to their clients. However, running a small business can also be challenging, especially when it comes to managing risks. One major risk that small business owners in the wellness and fitness industry need to be aware of is medical malpractice. Without proper medical malpractice insurance, a lawsuit or claim could have devastating consequences for your business.

There are several reasons why medical malpractice insurance is essential for small businesses in this industry. For starters, there is always the potential for injuries in following instructions or using your equipment. A successful suit based on these types of claims can result in significant financial losses for your business as well as damage to your professional reputation.

Additionally, as providers of health-related services, self-employed individuals are expected to provide quality care and the utmost attention to their clients to ensure that they do not experience any harm. However, mistakes can happen and it’s important to have the proper insurance coverage in place to protect yourself from these potential liabilities.

Ultimately, having medical malpractice insurance is crucial for any small business operating in the wellness or fitness industry. By understanding the risks associated with this line of work and investing in appropriate coverage, you can help to safeguard your business against potential lawsuits and claims while also providing peace of mind to your clients. This ensures that you can continue doing the important work of promoting healthy living with confidence and ease!

GEICO Policy Cost and Pricing Factors

The cost of a GEICO insurance policy depends on a variety of factors including the type and amount of coverage, your location, the size and structure of your business, and any past claims or incidents. However, GEICO offers competitive rates and multiple discounts to help lower the overall cost for small businesses. Plus, with convenient online tools such as a coverage calculator, GEICO makes it easy for small business owners to obtain and maintain their coverage.

It is worth noting that, as an auto insurance company, GEICO is known for its relatively lower premiums than you would get from other insurers. Despite this, they still offer top-notch customer service and are a well-branded provider within the industry.

Getting a Quote

Getting a quote from GEICO is easy because, as mentioned, they have a business insurance calculator to provide you with an instant estimate of your premium.

This calculator will also provide you with recommended coverages upon answering only six questions.

Alternatively, you could get a quote for each policy that they offer or contact them by phone by dialing (866) 509-9444.

GEICO Small Business Insurance Rating

GEICO is rated A++ and AA+ from AM Best and Standard and Poor’s, respectively as a wholly owned subsidiary of the Berkshire Hathaway Group.

How to Make a Claim with GEICO

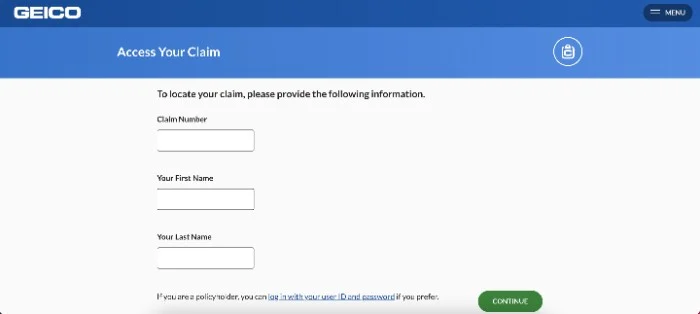

This insurer’s Claims Center allows you to report a claim online or by phone ((800) 841-3000).

After this, you can access your claim and locate its status in the process through their website. This is easier for policyholders with an account, so you could see all of them on one page if you have multiple or simply click without having to enter details such as your claim number.

3 Alternatives to GEICO

While GEICO is a convenient insurance company, especially for key coverages such as a BOP and commercial auto insurance, you may want to consider other industry leaders which we have listed below.

Chubb

Chubb is a larger insurance company available in 54 countries and territories with coverage offerings that could extend globally. Their wide array of forms of protection spans from serving students to multinational corporations for any type of activity from travel to engaging in transactions.

Beyond insurance, they also offer business solutions such as risk engineering and business income consultation if you are interested in resources for growing your enterprise. However, because of the size of this insurer, their processes make take longer since they cater to many entities.

In short, Chubb offers more varieties for coverage but GEICO may offer you the personal touch to insurance that you may be seeking as an owner of a small business. It all comes down to the extent of your operations and whether your risks are more general or specific.

Travelers

As does GEICO, Travelers Insurance Company also offers coverage for vehicles, property, and businesses. Additionally, this provider too has been around since the 1800s and also has an A++ or Superior rating from AM Best.

What sets it apart from GEICO is that they have unique options for more specific industries such as those in energy and construction, offering add-on coverages such as environmental liability and boiler and machinery protection designed for companies utilizing a lot of equipment susceptible to breakdown. They also offer business income and extra expenses such as for those in the food service businesses and pet care establishments because they are more at risk of loss during a lockdown, for example.

State Farm

Probably GEICO’s closest competitor, State Farm is the largest auto insurance company in the United States. GEICO comes as a close second.

Unlike GEICO which offers policies by category (i.e. medical malpractice, workers’ compensation for employees, etc.), State Farm focuses on industries and designs insurance for specific businesses such as retail shops and stores, independent contractors and trades, and other specialized professions such as business consultants and psychologists.

Bottom Line

Although known for auto insurance, GEICO has consistently proven itself to be a leader in the field of small businesses as well. Their key range of products, outstanding customer service, and unique branding have made them one of the most trusted providers in the industry.

Whether you’re looking for general liability coverage, workers’ compensation, protection for your business properties, or all of the above, GEICO is the clear choice for anyone looking to protect their beloved enterprise from risk. With their flexible options and user-friendly website and app, they make it easy for businesses of all sizes to access the coverage that they need.

So, if you’re looking to keep your small business safe and secure from more than just economic recessions, look no further than GEICO and its various offerings. With this provider, you can rest assured knowing that your business is in good hands.