InsuranceBee Review [2023]: Is It Good For Small Business?

Last Updated on January 20, 2023

When we think of small businesses, we often think of small shops such as food carts, bakeries, and salons. But, professional services are also small businesses selling their knowledge and expertise. Freelancers make a living off their skills.

After all, there are many reasons why people may be drawn to working for themselves. For some, it is a way to earn extra income outside of traditional employment. For others, it’s a means to have more control over their work schedule and projects. Whatever the reason, it is a good avenue to foster flexibility and freedom in their careers.

However, these small businesses also need insurance as do food carts, bakeries, and salons. With the number of people and other enterprises they deal with from day to day, it becomes necessary to be covered for liability.

It is for this very reason that InsuranceBee was created and operates. In this InsuranceBee review, we will take a look at the company’s offerings to underscore if they would be helpful for a pro like you.

Table of Contents

What’s Insurancebee?

Coverage

Cost

Claims

Alternatives

FAQs

What’s InsuranceBee?

InsuranceBee was created to provide freelancers and small firms with online liability insurance. This includes small businesses such as consultants, landscapers, janitors, merchants, and contractors.

This insurance agency was founded in 2010 and is headquartered in Maynard, Massachusetts. Their slogan is “liability insurance with a personal touch” as they have a team of advisors delivering cordial and convenient customer service.

Risks of Not Having Professional Liability Insurance

As a professional who provides services such as consulting, you may be held responsible for any losses incurred by your customers as a result of your advice. If you are accused of negligence or failure to deliver work, you may be in jeopardy of being sued.

Not having professional liability insurance could also cause tremendous reputational harm. News of being sued could spread, and, if you are unable to respond accordingly, it may become difficult to get new clients. This could have a significant impact on your business as you take a hit to your credibility as a professional.

Then, it only makes sense to be protected from professional liability as the risks are plenty and almost unavoidable in human work.

Types of Insurance Coverage Available

As they focus on liability insurance, InsuranceBee offers the following coverages:

General liability insurance: General liability insurance or small business liability insurance protects you from being held liable for injury to a customer or anyone who visits you, property damage if you have access to clients’ properties, personal injury if you may potentially cause someone reputational harm, and advertising injury should anyone accuse you of copying their ideas unintentional or not.

Professional liability insurance: Also called errors and omissions insurance, this is necessary for anyone who gives advice or service to clients. They may even ask for it before availing of your services in the first place. This will cover legal costs and compensation should you make a mistake in your work, give terrible advice resulting in losses for your client, omit something from your work, breach a contract, or fail to meet an agreed-upon deadline.

Business owner’s policy (BOP): A BOP combines general liability insurance and property insurance so not only are you covered for claims of harm to someone or their property but your own business assets are also protected, including your computer and printers.

Cyber liability insurance: Cyber liability insurance protects your company against the harmful effects of cybercrime especially if you store and/or send sensitive information online such as health records and payment details. It might be brought on by a data breach, or phishing, among other things.

Workers’ compensation insurance: If you hire other professionals and they get injured or become ill from working for you, workers’ comp will help settle medical bills, make up for their lost wages, and pay for legal expenses if the need arises.

Directors’ and officers’ liability insurance (D&O): D&O Insurance provides you, your company, and your personal belongings with protection from litigation based on poor leadership, mishandling funds, unethical employment practices, and breach of duty, among others.

Management liability: Management liability covers employment practices liability, directors’ and officers’ insurance, and fiduciary liability if you are accused of failing to do something you are responsible for under the law, such as not paying medical benefits for those that work for you.

Availability of InsuranceBee Services

Photo Credit: InsuranceBee

InsuranceBee provides services in 39 states as of this writing. The ones not included are Montana, Wyoming, North Dakota, South Dakota, Kentucky, West Virginia, Delaware, Vermont, Maine, Alaska, and Hawaii.

Getting a Quote from InsuranceBee

To get started on your quote, you may click “Get My Quote” on InsuranceBee’s landing page. You will be asked questions such as your state, business type, business structure, gross revenue, as well as other pertinent details.

You may also get in touch with an agent by calling 978.344.4215 but InsuranceBee communicates primarily through email (contactus@insurancebee.com) with which they will be sending your quote.

***

What is management liability?

Management liability is the legal term for the exposures and risks that directors, officers, managers, and administrators of a company face in their work. This type of liability can come from a variety of sources, including:

– Breach of fiduciary duty

– Mismanagement or abuse of power

– Conflict of interest

– Fraud or embezzlement

– Discrimination or harassment

As such, management liability insurance is a package of coverages designed to protect from this wide array of risks and combines fiduciary liability, employment practices liability, and D&O liability as discussed in the previous section.

InsuranceBee Policy Cost and Pricing Factors

As mentioned, your quote from InsuranceBee will depend on many factors such as how much you pay yourself and/or your employees, the types of insurance you want to purchase, your claims history, and more.

They also offer different coverage levels for each type with varying inclusions for added protection. For instance, standard cyber liability starts at $42 monthly and covers incident response while paying $89.25+ monthly includes post-breach repair.

Reporting a Claim with InsuranceBee

Speaking of claims, you may file one by hovering over “Policyholder Services” and clicking “Make a claim” under Manage Your Policy.

By doing so, you will be taken to a contact form asking for the following details so that their team could know more and communicate with you:

- Business name

- Policy number

- Title and First and Last Name

- Phone Number

- Email address

- Main business activity

- Date of claim occurrence

- A summary of the claim

InsuranceBee Customer Reviews

InsuranceBee has a 4.7/5 rating from Feefo wherein they have gotten 62 reviews.

Here are some testimonials from other busy bees who have gotten assistance from the agency:

Positive Comments

This recent customer is very happy to have received his/her policy on time.

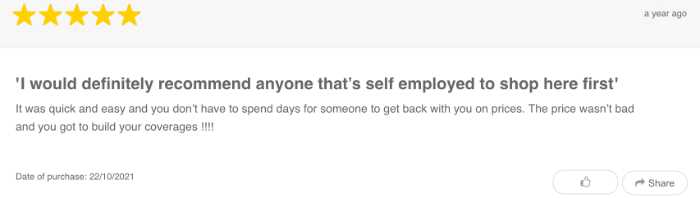

This self-employed client recommends InsuranceBee for other businesses that are structured the same as he was able to get a fast quote and customize his coverage.

Negative Comments and Points of Improvement

Many poor reviews were complaining about the waiting time to get in touch with a live agent or get their certificate to show to customers. Some policies also take a while to get to their holders as InsuranceBee is only a broker and have to communicate with insurers.

Moreover, a handful of past clients complained about the customer service as the representatives were not as knowledgable and referred them to the website for information.

Alternative Providers of Liability Insurance

Although they specialize in liability insurance, this coverage is a typical kind of insurance and is offered by most other insurance providers. In this section, we take a look at some alternatives and how their liability insurance compares to that of InsuranceBee’s.

What is NEXT?

An online insurance provider for small enterprises based in Palo Alto, California, NEXT is a new brand that sells policies and caters to a wide range of small businesses from real estate agents to consultants and lawyers. You may learn more about the company and its offerings in our detailed review.

NEXT vs. InsuranceBee

Professional liability insurance is offered by NEXT Insurance at a price starting from $18.34 per month, whereas InsuranceBee charges as little as $270 per year (or $22.5 per month). As such, NEXT may be less expensive and a better choice if you are looking to save more money.

Besides their price points, their difference also lies in other types of coverage as NEXT does not offer protection for cyber liability and management liability.

What is Simply Business?

Simply Business is another insurance brokerage that was founded in 2005 in the United Kingdom. Although they offer a range of insurance solutions, they also focus on people as a certified B corporation and also offer liability coverages from general to professional to cyber. Read our Simply Business Review for further information.

Simply Business also offers Sole Proprietors Workers Compensation if you would like to have workers’ comp for yourself as a business owner.

Simply Business vs. InsuranceBee

Simply Business does not offer management liability as does InsuranceBee, but they do have the rest of the latter’s offerings. With this, the key difference between the two would be in their policy prices so it would be a good idea to compare quotes before deciding which provider you will go with.

Moreover, Simply Business also only has offices in Boston and London which may be a thing to consider if the location of your insurer is significant to you.

What is Embroker?

Embroker is an insurance company founded in 2015 and headquartered in San Francisco, California that only does business online, which means they don’t waste money on inefficiencies like paper processing. Their use of modern technology–from machine learning to artificial intelligence–makes policies more tailored to the customer, less expensive, and easier to purchase than other insurance companies. See our Embroker full review to learn more.

Embroker vs. InsuranceBee

Besides professional liability, Embroker also offers management liability from directors’ and officers’ liability to employment practices as opposed to the previous alternatives. Another unique offering by the agency is Key Person Insurance designed to protect a critical of your business whether he/she is the CEO or an employee that had become a key contributor.

Embroker also offers a startup package including D&O, employment practices, and fiduciary liability, along with tech errors and omissions plus cyber insurance for businesses offering technological services and products. You may want to go with Embroker if your business is a venture-backed startup. Otherwise, InsuranceBee also has the coverage you may need as a professional or skilled employee.

The Bottom Line

Professionals, independent firms, and freelancers need insurance as do shops and other small businesses in other trades. When you deal with people who rely on your expertise, you are at risk of being held liable for any harm. Get your liability insurance today!

FAQs about InsuranceBee

Is InsuranceBee accredited?

Yes! The company had been accredited by the Better Business Bureau since 2011.