Thimble Insurance Review [2023]: Is This Provider Right For Your Small Business?

Last Updated on January 19, 2023

Small businesses are the rhythmic heartbeat of the US economy. They account for more than half of all private sector jobs in the country, but the unfortunate thing is that they are also among the most vulnerable enterprises, often operating on tight budgets from personal savings with little room for error. This is why it is so important for small business owners to have adequate and right business insurance in place.

In this article, we will be providing an overview of Thimble Insurance- what they offer in terms of coverage, their strengths, and weaknesses as a company, and how they compare to others in the field. By the end, you should have a good idea of whether or not Thimble is the right provider for your business insurance needs.

Table of Contents

What’s Thimble Insurance?

Pros and Cons

Coverage

Cost

Claims

Thimble Alternatives

FAQs

The Risky Business of Not Having Insurance

Businesses, especially small and starting businesses, face many risks. One of the biggest risks is not having business insurance. It can help cover expenses if your business is sued for negligence, property damage, or injuries. Without it, you could be facing a lot of financial trouble.

The ideal policy can give you the peace of mind to run your business while lessening the expensive consequences that may come from unfortunate events. If you’re looking for good coverage options at an affordable price, continue reading our Thimble Business Insurance review.

What’s Thimble Insurance?

Thimble is an insurance company that was originally founded by Jay Bregman and Eugene Hertz back in 2016. The company started as a drone insurance provider but has since expanded its small business insurance coverage to include other industries. Thimble’s headquarters are located in New York City, and the company now serves more than 60,000 small business owners across the United States.

There are a variety of different policies offered by Thimble, which can be customized to fit the specific needs of your business. Some of the most popular types of coverage that Thimble provides include general liability insurance, product liability insurance, and event insurance.

The Pros and Cons of Thimble

There are a few pros and cons of working with Thimble that you should consider before deciding whether or not to purchase a policy from them.

The Pros

Thimble business insurance is simple, scalable, and flexible. They are an A-rated provider that primarily serves small businesses by offering policies that fit their type and structure and matching their changing needs as they grow. This means that you can find a policy with Thimble that fits you rather than being forced to purchase a one-size-fits-all policy.

Additionally, the process for quoting and purchasing a policy from Thimble is streamlined and easy to understand. You can get a quote online or over the phone, and they promise no hidden fees. Lastly, Thimble has an app that allows you to access your policy online, anytime…anywhere.

The Cons

On the downside, Thimble offers only eight types of small business insurance coverage because, as mentioned, they cater to smaller businesses. Therefore, this may be something you should consider if you are already a sizable enterprise.

Thimble’s newcomer status in the insurance space may also be something that clients could be wary of. While they have excellent ratings from AM Best and Better Business Bureau, Thimble competes with more established and longstanding agencies.

In the end, these are not necessarily dealbreakers for business owners and, for its lower price point, Thimble could still be worth considering.

Types of Insurance Offered by Thimble

Thimble offers nine types of small business insurance policies. Here are some of the more common types of coverage and how they can help protect business owners:

General liability insurance: This is a common type of business insurance that covers you for usual third-party claims such as bodily injury, property damage, and personal and advertising injury that may arise from your services, products, or advertisements.

Professional liability insurance: Also known as “errors and omissions” insurance, professional liability coverage is necessary for professionals to safeguard their reputation and shoulder legal defense costs if the need arises. For instance, if you are a business consultant, mistakes could lead to great financial losses for your customer, and professional liability insurance addresses claims relating to actual or alleged negligence in your work.

Business equipment insurance: Business equipment protection looks after loss or damage of important equipment that is in the owners’ possession, such as computers, machinery, or tools. It is popular among self-employed workers so they could keep their assets safe.

Commercial property insurance: As opposed to business equipment insurance, this type protects businesses from loss or damage to their property in their physical locations from the exterior to maintenance equipment.

Business owners’ policy: This policy coverage combines general liability insurance, commercial property insurance, and business interruption insurance. For instance, it could cover the legal fees for investigation for property damage, its replacement, and loss of income resulting from temporary closure for repairs.

Workers’ compensation insurance: Workers’ comp insurance benefits both the employee and employer by covering medical expenses that may be needed for employee check-ups or treatment for illnesses or injuries he/she has gotten while performing work.

Event insurance: Protects third parties in events organized by businesses such as vendors and attendees. It also includes liquor liability which will cover expenses for bodily injury or property damage caused by serving alcohol at your event.

Drone insurance: A unique offering from Thimble that most other insurance companies do not offer. Using the Verifly app, you can get liability insurance from Thimble for both recreational and commercial drone flights with a policy price depending on the length of your session and geolocation.

Which type of insurance is right for your business depends on many factors, such as the type of business you have, the products or services you offer, and the risks associated with your business.

Thimble Availability

Thimble is available in all 50 states. However, they also have limits to their insurance options and do not offer commercial auto insurance or cover event cancellation.

How Much Does Thimble Insurance Cost?

The cost of your commercial insurance from Thimble will vary depending on several factors, including the industry you’re in, your location, your management practices, your deductible, the value of your property and equipment, the amount of coverage you need, how long you need it, and your claim history.

In order to get an accurate picture of how much a policy from Thimble will cost for your business, it would be best to get a quote from a licensed insurance agent. They are the ones who will be able to take all of these factors into account and give you a tailored quote that meets your specific needs.

What Is A Certificate of Insurance?

As a Thimble customer, you will have instant access to your COI after purchasing your policy. You will get it either via mail or email.

Your certificate of insurance, also known as COI, is a one-page insurance document that provides proof that your business has adequate coverage. This document is issued by your insurer or a representative for free and shows your customers and partners that your company is financially responsible and able to pay for any damages that may occur.

A COI typically includes the name of the business and its owner, the effective date of coverage, your state and address, the type of coverage included in your policy, the limits and deductibles, and the policy expiration date. Some customers may want to see your COI before they do business with you so they have reassurance for any potential liability or losses.

Not only does having a COI enhance your business relationships but it, above all, mitigates risks in your conducting business.

Reviews from Thimble Customers

Now that we have covered Thimble’s features, it would be best to see how past clients were (or were not) able to make use of them by reading some reviews. Of course, we start with the positive comments.

Five-star Reviews

As Thimble claims, its app interface “lessens questions” while simultaneously giving clients more options for their coverage. This customer is also particularly happy about the immediacy of COI issuance.

This DJ is satisfied that he was able to get insurance for only a day with Thimble as he rendered his services for a wedding.

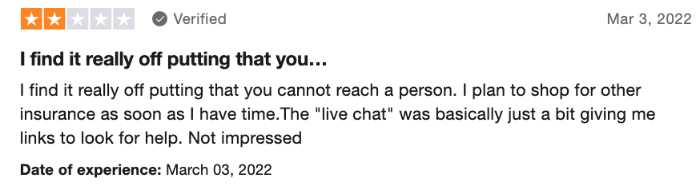

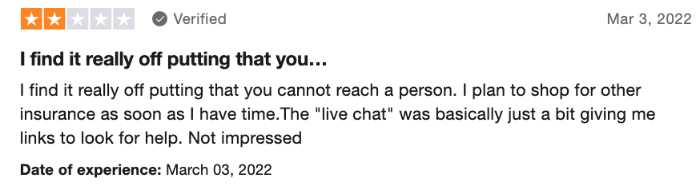

Unsatisfactory Ratings

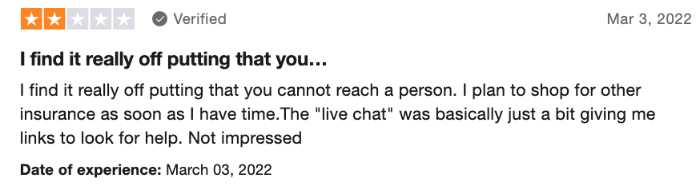

Although Thimble features a means to contact support, many have voiced their qualms about the lack of a contact number to get in touch with a Thimble agent.

This customer had a similar experience as he was only being redirected to links for more information.

As you may know as an owner of a business, the insurance industry is built on consumer trust and relationships so companies like Thimble need to provide easily accessible contact information and responsive support for their policyholders.

Filing A Claim With Thimble

If you need to file a claim with Thimble, just follow these simple steps and you’ll be on your way.

One option is to scroll down their landing page and check the Resources to file a claim.

However, if you have an account, you can log in and go to the “Claims” tab. From there, you will see a list of all of your current claims. If you have multiple claims, you can use the drop-down menu to select the one you want to work on.

Afterward, press the “File a Claim” button. By doing so, you will be transferred to a new page where you will be able to fill in all the data regarding your claim. Remember to be as thorough as possible so Thimble can manage your claim rapidly and without any issues.

Alternatives to Thimble

What is Next Insurance?

Next offers a variety of products and services to its customers. Next was founded in 2013, has over 500 employees, and serves businesses of all sizes and industries. Next Insurance offers a variety of product options, including liability insurance, property insurance, workers’ compensation insurance, and more.

The company also offers a variety of discounts and features that make it an attractive option for small businesses. Next Insurance is a leading provider of small business insurance and has been recognized by Forbes, Inc., and other publications.

Thimble VS. Next Insurance: Which is Better?

Thimble and Next are comparable as they cater to small businesses and offer fast quotes with competitive pricing. However, Next could have more types of coverage for their clients such as commercial auto insurance and product liability insurance. They also offer discounts for bundled policies and other ways to save money on premiums such as renewing early. For more details, be sure to read our full Next Insurance review.

On the other hand, Thimble small business insurance prides itself on the simplicity of its processes and scalability of its policies that enable them to grow along with the businesses. They promise no flexible plans, no fuss, easy cancellations, as well as no hidden fees.

What is Hiscox Insurance?

Hiscox is a major provider of insurance solutions for both businesses and consumers. Some of the policies they offer include liability, property, and workers’ compensation. Hiscox has over a century of expertise providing excellent customer service.

The company has over 2,000 employees and serves customers in over 100 countries. Hiscox is headquartered in London, England.

Thimble vs Hiscox Insurance: At A Glance – Head to Head

As mentioned, Hiscox has been in the industry for many years and has multiple offices in the United States which may be bonuses for small businesses looking to get insured. They also offer other coverage types from general liability, and professional liability, to cyber and data insurance and product liability insurance which are not available with Thimble.

However, it is known that Hiscox’ premiums may be on the pricier side, so Thimble may be the less intimidating option especially for smaller and newer businesses. Thimble also offers insurance policies that span for as long as you need, whether it’s by the hour or month.

What is Simply Business Insurance?

Simply Business Insurance understands that every business is different, and we offer a range of insurance products and services to suit businesses of all sizes. Simply Business wants to make things easy for you. They offer a ton of insurance products like general liability, business personal property, workers’ compensation, and more. Plus, our customer service is amazing and rates are very competitive.

Simply Business was founded in 2005. The company has over 200 employees, serves customers in the United States, and is headquartered in Boston, Massachusetts.

Thimble vs. Simply Business Insurance: The Face Off

Both Thimble and Simply Business are available in all 50 states. One difference would be that Simply Business makes finding the right policy easier as they list their coverage selections by business and business type.

As such, Simply Business may be the better option if you are looking for something more tailored for your current operations, while Thimble small business insurance is considerable if you are only starting and are a growing enterprise.

Simply Business has also been an insurance broker for longer than Thimble, having been founded in 2005—that is about a difference in decade when it comes to experience. However, the fact that Thimble was started more recently may mean it could adapt better to newer businesses and niche areas of the market.

Overall, these companies offer you the financial strength and financial protection your starting business needs, but it is up to you to explore their coverage options to grasp which of them would provide best insurance for you at this point.

The Bottom Line

There are a lot of providers in the market and choosing the right provider only boils down to what you and your business need. Thimble wants to put small businesses in control of their policies so they have not only streamlined the policy purchasing process but made it scalable and easy to cancel if necessary. Experience the fuss-free environment of Thimble by getting a quote from their site today.

FAQs about Thimble

Is Thimble small business insurance a legit provider?

Definitely! Thimble is an A-rated Markel insurance company by AM Best. They have helped over 60,000 businesses and sold over 200,000 policies since their establishment in 2016.

Is Thimble reliable?

Yes. As of the moment, they cover over 300 types of professions and businesses and boast a 4.6/5 rating on Trustpilot.