Workers Compensation Insurance Decoded

Last Updated on June 16, 2023

Workers’ compensation insurance is a type of insurance that provides coverage for employees who are injured or become ill as a result of their job. It is required in most states and helps protect both the employee and the employer from any potential liability. In this blog post, we will discuss everything you need to know including what it covers, how to get it, and why it is important.

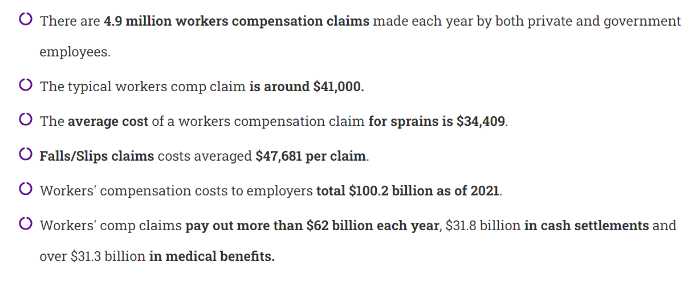

Did you know…

Source: simplyinsurance.com

Of course, not all of these claims are valid and many are for very small amounts. Still, the total cost of workers’ compensation claims is a huge burden on businesses and the economy.

Despite its importance, many small business owners don’t fully understand their policy, what it covers, the risks of not having coverage, or how much it costs.

What is workers’ compensation insurance?

Workers’ comp insurance is a type of insurance that provides coverage for workers who are injured on the job. This coverage can help to pay for medical expenses and lost wages. It’s typically required by law in many states for businesses that have employees.

What does workers’ compensation insurance cover?

In the United States, workers’ comp coverage is an insurance solution that provides benefits to employees who are injured or become sick as a result of their job.

Workers comp coverages can include:

Medical expenses – This can include hospitalization, prescriptions, doctor’s visits, and physical therapy.

Wage replacement – if an employee is unable to work due to an on-the-job injury, workers’ compensation can provide a percentage of their lost wages

Death benefits – if an employee dies as a result of an on-the-job injury, workers’ comp can provide death benefits to the employee’s surviving spouse and/or dependent children

Rehabilitation costs – if an employee needs help returning to work after an injury, workers’ compensation can cover the cost of vocational rehabilitation services.

There are two main types of workers’ compensation policies: state-run programs and private insurance plans. State-run programs generally cover all employers and provide benefits to all employees who are injured on the job.

Private insurance plans are typically offered by employers to their employees as part of a benefits package. These plans may have different coverage levels and may not be required by law.

Workers’ compensation insurance can help to protect employees from financial hardship if they are injured on the job. It can also help to ensure that employers are held liable for workplace injuries and illnesses.

Coverage Limitations

There are a few things that this insurance does not cover, however. These include injuries that occur while an employee is intoxicated, injuries that occur while an employee is engaging in illegal activity, and injuries that occur due to the negligence of the employer. It generally does not cover psychological injuries or stress-related illnesses.

Despite these exclusions, this insurance is an important safety net for employees who are injured on the job. It can help them cover medical expenses and lost wages while they recover from their injuries.

Workers’ compensation insurance can also provide peace of mind for families of workers who are killed in work-related accidents, by providing death benefits to help them cover funeral expenses and other costs.

What are the benefits of having workers’ compensation insurance coverage in place?

There are many benefits to having coverage in place. Perhaps the most important benefit is that it can help protect your business from financial ruin in the event that one or more of your employees is injured on the job.

Another important benefit of workers’ comp insurance is that it can help you attract and retain quality employees. Many workers are reluctant to take jobs with companies that do not have adequate workers’ compensation coverage in place. By having this coverage in place, you can show potential employees that you are committed to providing a safe work environment.

There are many other benefits of workers’ compensation insurance, including peace of mind for employers and protection from lawsuits. It’s one way to help ensure that your employees are taken care of if they are hurt on the job.

Who needs Workers’ Compensation insurance?

If you have employees, you probably need it. In most states, it’s the law. Even if it’s not required, it’s a good idea.

Businesses that need to carry such insurance include:

Manufacturing businesses – Claims and lawsuits are common in the manufacturing industry. If an employee is injured on the job, they may file a claim. If the injury is serious, they may also file a personal injury lawsuit against the company.

Construction companies – Construction is a dangerous industry. There are a lot of potential hazards, from falling objects to electrical accidents.

Restaurants – are another high-risk industry. There are a lot of potential hazards in the kitchen, from sharp knives to hot ovens.

Hospitals and other medical facilities – are required to carry it in most states. This is because there are a lot of potential hazards in the medical field, from exposure to dangerous chemicals to lifting patients.

Retail stores – are another type of business that needs to carry this insurance. This is because there are a lot of potential hazards in the retail industry, from lifting heavy boxes to dealing with irate customers.

Cleaning businesses – are also high-risk. There are a lot of potential hazards, from slips and falls to exposure to cleaning chemicals.

Contractors – are required to carry Workers’ comp insurance in most states. This is because there are a lot of potential hazards on the job, from heavy equipment to heights.

As you can see, there are a lot of businesses that need this often state-required coverage. If you have employees, you need to make sure you have workers’ comp insurance.

Dangers of not having workers’ compensation insurance

If you don’t have workers’ compensation insurance and an employee is injured on the job, they may sue you for their medical expenses. If the injury is serious, they may also sue you for lost wages and pain and suffering.

If you don’t have workers’ compensation insurance and an employee is killed on the job, their family may sue you for wrongful death.

If you are found guilty of not maintaining coverage, you may be fined or even jailed.

As you can see, there are a lot of risks to the employer if there’s no workers’ compensation coverage. It’s important to make sure you have this type of insurance to protect your business.

So how much does Workers’ Compensation insurance cost?

There are a few factors that determine the cost of workers’ compensation. The first factor is the state you’re in. Rates vary from state to state.

The second factor is the size of your business. The bigger your business, the more expensive your insurance will be.

The third factor is the industry you’re in. As we mentioned before, some industries are more dangerous than others. If you’re in a high-risk industry, your insurance will be more expensive.

The fourth factor is the claims history of your business. If you’ve had a lot of claims in the past, your insurance will be more expensive.

The fifth factor is the amount of coverage you need. The more coverage you need, the more expensive your insurance will be.

So those are some of the factors that determine workers’ compensation costs. As you can see, there are a lot of factors that go into the cost of this type of insurance. It’s a necessary part of doing business, and it can protect your business from a lot of financial risks.

How to get Workers’ Compensation Insurance?

Now that you know the importance of workers’ compensation policy insurance, you’re probably wondering how to get it.

The first step is to contact your state’s workers’ comp office. They will be able to tell you what the requirements are for your state.

The second step is to contact an insurance agent who specializes in this vital policy. They will be able to assist you in selecting the appropriate coverage for your company.

The third step is to compare prices and coverage from different insurance companies. This is the best way to make sure you’re getting the best deal.

The fourth step is to make sure you’re compliant with all the requirements of your state. You don’t want to get fined or penalized for not having the right insurance. It’s important to have this type of insurance to protect your business from financial risks.

Top Workers Compensation Insurance Companies To Consider

Now that you know the importance of workers compensation insurance, you’re probably wondering which insurance companies you should consider. Here are a few of the top workers compensation insurance companies:

Next Insurance – offers workers’ comp insurance coverage for businesses of all sizes. They have a simple online application process and you can get a quote in minutes.

The Hartford – is one of the largest insurance providers in the United States. They have a long history of providing quality coverage for businesses.

Hiscox – Hiscox is a leading provider of workers’ compensation policies for small businesses. They have competitive rates and offer a variety of coverage options.

biBerk – biBerk is a leading provider of workers’ compensation plans for businesses of all sizes. They have competitive rates and offer a variety of coverage options.

There are many insurance providers out there. And it can be hard to know which one is the best for your business. But if you consider these four companies, you’ll be on your way to finding the best coverage for your business.

It’s important to make sure you have the right coverage for your business. You don’t want to be underinsured or overpaying for your coverage.

Ways To Reduce Worker’s Compensation Claims

There are a few things that you can do to help prevent workers’ compensation claims. First, make sure that your employees are properly trained and aware of the dangers of their job. Second, provide them with the proper safety equipment and supplies.

Finally, make sure that your workplace is clean and free of hazards. By taking these steps, you can help reduce the number of workers’ compensation claims made each year.

Final Word

If you’re a small business owner, it’s important to have this often-required insurance in place. Not only does this coverage protect your employees in the event of an on-the-job injury, but it can also help protect your business from potential lawsuits.

And, if you’re looking for an affordable workers’ compensation policy we’ve got you covered. Check out our comprehensive small business insurance reviews and feel confident that you’re getting the best deal possible on the coverage you need.

Suggested Reading

General Liability Insurance: The Must-Have Protection for Your Business

Why Your Business Needs Commercial Auto Insurance

Errors and Omissions Insurance: A Protective Small Business Shield

Yes, Small Business Pros Need Professional Liability Insurance (PLI)

Business Owners Policy (BOP) Insurance Shields Against Financial Losses