Yes, Small Business Pros Need Professional Liability Insurance (PLI)

Last Updated on June 16, 2023

No one ever expects to be sued, but the reality is that any business can be targeted. Whether you’re a consultant, electrical contractor, or small business owner, professional liability insurance (PLI) can help protect you from costly lawsuits.

With professional service expenditures expected to reach $600 billion in 2023, somewhere in that pile of cash will be some disgruntled customers and clients. If they believe you failed to deliver on your promises, didn’t perform up to industry standards, or even just gave them bad advice, they could sue you for damages.

Why Is Professional Liability Insurance so important?

Also known as errors and omissions (E&O) insurance, this type of coverage can help protect you from costly lawsuits alleging that you made a mistake in your work or failed to deliver on a promise.

It’s one thing to be sued, but it’s another thing entirely to have to pay for the damages out of your own pocket. If you’re found liable, E&O insurance can help cover the cost of settlements or judgments, as well as attorney’s fees and other defense costs.

In an age where social media is ubiquitous, businesses need to be prepared for slander and defamation claims from disgruntled clients or former employees.

E&O insurance can also help protect your business’s reputation. A lawsuit, even if it’s ultimately dismissed, can do serious damage to your business’s good name. And that’s something money can’t always fix.

Professional Liability vs General Liability insurance

Two common types of business insurance are professional liability insurance (PLI) and general liability insurance (GLI). So, what’s the difference between the two?

Professional liability insurance, also known as errors and omissions insurance, protects your business from claims that arise from professional services that you or your employees have provided. This type of coverage can help cover the costs of legal defense and any damages that may be awarded in a lawsuit.

General liability insurance, on the other hand, protects your business from a variety of claims, including bodily injury, property damage, personal injury, and more. This type of coverage can help pay for medical expenses, legal defense costs, and any damages that may be awarded in a lawsuit.

While both types of insurance are important for businesses, they each provide different types of coverage. So, it’s important to understand the difference between the two before you purchase insurance for your business.

Who Needs Professional Liability Insurance?

This type of insurance is vital for any business that provides advice or services to clients, as it can help cover the costs of settlements or judgments resulting from lawsuits. Some examples of professions that typically purchase PLI include:

Doctors

Lawyers

Architects

Engineers

Accountants

Financial advisors

IT professionals

Graphic designers

Advertising agencies

Fitness professionals

If you are in any of these professions or provide similar services, it is important to make sure you are properly protected in case of a lawsuit. Professional liability insurance can give you peace of mind knowing that you will be financially covered if something goes wrong.

In some cases, E&O insurance may be required to win certain bids or contracts. For example, many government contractors are required to carry this type of insurance.

How Does Professional Liability Insurance Work?

Professional liability insurance (PLI), also known as errors and omissions insurance (E&O insurance), is designed to protect businesses from claims arising out of their professional services.

PLI policies typically have three main coverage parts:

Damages: This covers the cost of settlements or judgments awarded to the plaintiff.

Legal defense costs: This covers the cost of attorneys’ fees and other legal expenses incurred in defending the policyholder against the claim.

Disciplinary proceedings: This covers the cost of proceedings brought by a professional licensing board or organization as a result of the policyholder’s alleged professional misconduct.

PLI policies are typically written on a claims-made basis, which means that the policy will only cover claims that are reported during the policy period. In addition, most PLI policies have a retroactive date, which is the date after which the policy will cover claims arising from errors or omissions that occurred.

Some PLI policies can also be written on an occurrence basis, which means that they will cover claims that occur during the policy period, even if the claim is reported after the policy expires.

Regardless of the type of policy, PLI can help cover the cost of damages, legal defense costs, disciplinary proceedings, and loss of earnings. It can also assist with subpoenas.

What Does Professional Liability Insurance Cover?

PLI an cover a variety of claims, including:

Negligence: This is when a business is accused of failing to provide the standard of care that is expected in its industry.

Hallie, an IT consultant, stared at the screen, her heart racing. One of her client’s computer systems had fallen victim to a cyber attack, and now they were suing her for damages. She knew she was innocent, but how could she prove it? She thought back over her work on the project and tried to remember any mistakes she might have made. But she couldn’t think of anything. Is she prepared to defend herself and prove her innocence? Or would she lose everything?

Misrepresentation: This is when a business is accused of making false or misleading statements about its products or services.

Inaccurate advice: This is when a business is accused of giving inaccurate advice that leads to financial loss for the client.

Harrison, a financial planner, knew his business was at risk. He had been wrongfully accused of giving inaccurate advice to one of his clients, which had led the family to lose their deceased relative’s entire estate to probate. Thankfully, he had professional liability insurance to help protect his business and reputation. Without it, he would have been bankrupt and out of a job.

Personal injury: This is when a business is accused of causing personal injury, such as libel or slander.

Even if you didn’t do anything wrong, your client may sue your firm if they believe you made an error. If you don’t have insurance coverage, then you will be stuck having to pay for legal defense costs yourself.

What Does Professional Liability Insurance Not Cover?

Although professional liability insurance (PLI) can offer vital protection, it doesn’t cover everything. Most professional liability policies exclude coverage for certain types of risks, including:

Bodily injury or property damage: PLI generally won’t cover you if you cause physical harm to someone or damage their property.

For example, if you’re a doctor and your patient is injured due to your negligence, your PLI policy wouldn’t cover the resulting damages.

Fraudulent acts: If you intentionally commit fraud or engage in other dishonest behavior, your PLI policy wouldn’t cover any resulting claims.

Employment matters: PLI policies also typically exclude employment-related disputes, such as wrongful termination, sexual harassment, and discrimination claims.

False advertising: Many PLI policies exclude coverage for claims arising from false or misleading advertising.

Personally identifiable information: PLI policies generally don’t cover claims relating to the unauthorized use or disclosure of personally identifiable information (PII).

Intellectual property: Most PLI policies exclude coverage for intellectual property claims, such as patent or copyright infringement.

Criminal acts: PLI policies typically exclude coverage for any criminal acts you may have committed.

If you’re unsure whether your PLI policy will cover a particular risk, be sure to ask your insurance agent or broker. They can help you understand the coverage limitations of your policy and determine if you need any additional insurance protection for your business.

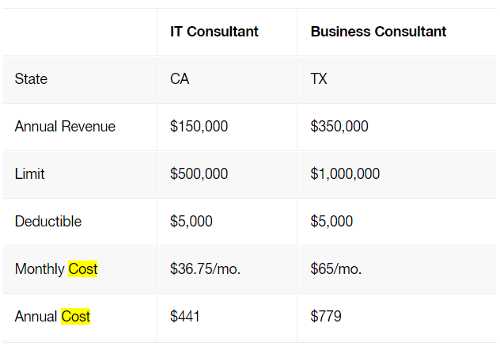

How Much Does Professional Liability Insurance Cost?

Professional liability insurance costs are unique to your business. Factors that can impact your errors and omissions insurance cost include:

- Policy details, like coverage limits

- Industry

- Location

- Business size, # of employees, and customers

- How long you’ve been open for business

- Claims history

To get a tailored PLI quote for your business, contact an insurance agent or broker.

Get A Professional Liability Insurance Quote

There are many places where you can get a professional liability insurance quote. You can go to an insurance agent, broker, or company. You can also get quotes online.

When you get a quote, you will need to provide some information about yourself and your business. This includes your contact information, the type of business you have, how many employees you have, and your revenue. You will also need to provide some information about the coverage you need.

Once you have this information, the insurance company will give you a quote. The quote will include the premium, the deductible, and the limits of coverage.

Compare Coverage and Rates

When you compare quotes, you will want to make sure that you are getting the same coverage for the same price. You may also want to compare the deducible and the limits of coverage. There are only a few small business insurance providers we recommend.

***

What are the risks of foregoing professional liability insurance?

As a business owner, you are likely aware that professional liability insurance is a requirement in many states. If you are sued and do not have coverage, you may face serious consequences such as suspension, additional fines, and initial litigation settlement costs.

Without professional liability insurance, you are putting your business at risk for these potential penalties. If you are sued and found to be liable, you may be required to pay damages to the plaintiff. These damages can include the cost of medical treatment, lost wages, and pain and suffering.

In some cases, you may also be required to pay the plaintiff’s attorney’s fees. If you are unable to pay these fees, you may be forced to declare bankruptcy.

Even if you are found not liable in a lawsuit, the cost of defending yourself can be significant. An experienced attorney can cost thousands of dollars per hour, and the costs of expert witnesses can also add up quickly.

If you are found liable in a lawsuit, you may also be required to pay punitive damages. Punitive damages are designed to punish the defendant and deter future wrongdoing. They can be much higher than actual damages, and they are not covered by insurance.

As you can see, the risks of not having professional liability insurance are significant. Don’t gamble with your livelihood.

Wrap Up

Professional liability insurance is one of the most important types of insurance a small business can have. It protects your business from claims of negligence or malpractice. The cost of professional liability insurance varies depending on your industry and the size of your company, but it’s worth the investment to protect yourself and your business.

If you’re not sure whether professional liability insurance is right for you, read our comprehensive small business insurance reviews and feel confident in choosing the right policy for your company.

Suggested Reading

Business Owners Policy (BOP) Insurance Shields Against Financial Losses

Why Your Business Needs Commercial Auto Insurance

The Importance of Data Breach Insurance for Small Businesses

Workers Compensation Insurance Decoded

Advantages of Product Liability Insurance for Your Small Business