Electrical Contractor Liability Insurance Won’t Shock Your Pockets

Last Updated on January 19, 2023

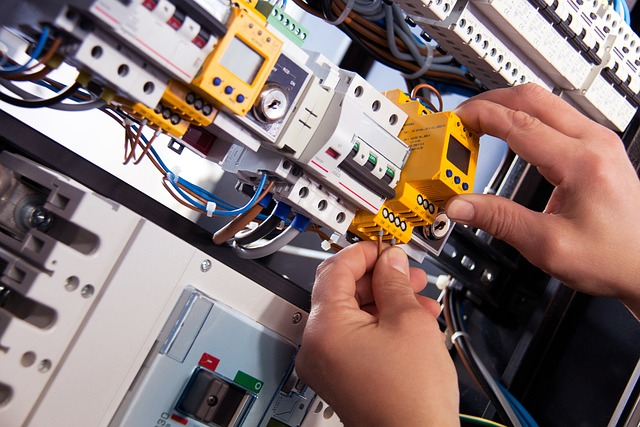

As an electrical contractor, you are constantly working with high-voltage equipment and wiring. This puts you at a higher risk for accidents affecting your business and even damages incurred by other people. That’s why it’s so important to have electrical contractor insurance in place. This type of insurance can protect you from financial losses if you’re ever sued for damages stemming from an unfortunate event that occurs on the job.

In the following, your next questions may be, how exactly does it work? Where can I get electrician liability insurance?

In this article, we shall provide answers to those questions and more. We’ll also give you some tips on how to get the most affordable electrician insurance for your business.

What is electrical contractor liability insurance?

General liability insurance is a broad form of insurance that covers general business risks, while an electrical contractor is a professional who specializes in the design, installation, and maintenance of electrical systems. In essence, then, electrical contractor insurance is a form of coverage designed to address the risks commonly encountered by those in the electrical contracting business.

In itself, electrician insurance helps pay for resulting medical bills, legal costs, and/or property fees if you or your employees in your electrician business accidentally injure someone or damage anyone’s property. Without this type of coverage in place, you could be facing serious financial problems if something happens.

Electrician liability insurance might also be required for electricians in some states, and, because electricity could be dangerous to work with, having this coverage gives your clients the peace of mind of knowing you are not only authorized to do work but have the financial backing should anything not go as planned while rendering your services.

What does electrical contractor liability insurance cover?

Most electrical contractor insurance policies will cover the following:

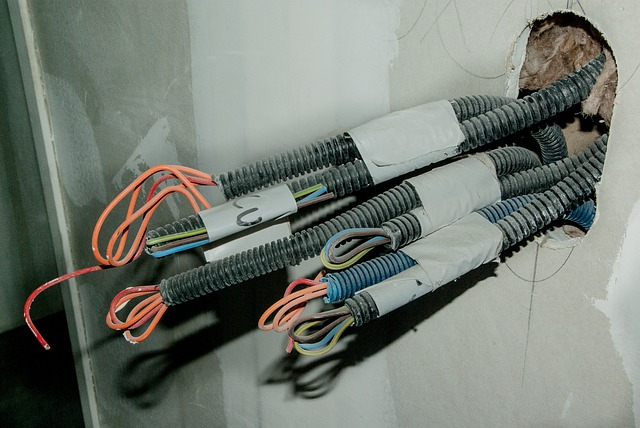

Bodily injury. Bodily injury from electrical risks (e.g. arcing, fire, explosions) which includes shocks and burns is the most common type of claim for electrical contractors on a job site. And while these usually affect employees, exposed electrical parts could injure just about anyone who comes near them . If any of these happen, your electrical contractor business insurance coverage would pay for the medical expenses.

Property damage. Installed electrical appliances and wirings could malfunction, overload, or short-circuit and cause electrical damage to property. Furthermore, seemingly minor electrical problems like exposed wires can lead to much more significant issues. And, if you or one of your employees accidentally damages someone’s property while on the job, your electrical contractor liability insurance policy will help pay for repairs and replacements.

However, as an electrical contractor, you should be aware that general liability electrician insurance does not cover damage to your own property such as your machines and devices. Therefore, you may wish to consider other types of coverage such as commercial or business property damage insurance, auto insurance, or tools and equipment insurance to protect your own assets.

Consequently, your liability insurance could reimburse you for medical examinations and treatment, repair or replacement of damaged property, as well as attorney’s fees if a lawsuit is filed. Having this policy can save you a lot of money in the long run, which is why every electrical contractor should make sure to include it in their plans.

How much does electrical contractor insurance cost?

Electrical contractors insurance costs will differ based on various conditions, such as the kinds of projects you work on, where these projects are situated, your payroll, and how many employees you have. For example, if your employee base is large and you often work on high-risk projects such working in as tight workspaces and dealing with overhead cables, your insurance costs will be higher than if you have a small employee base and mostly work on smaller projects with minimal risks such as home installations.

And while it may be tempting to go with the cheapest option, it’s important to make sure that you are getting the coverage you need. Read on further for more tips as well as some top providers of electrician business insurance to help narrow down your choices for getting the best deal.

How can I get the best electrical contractor general liability insurance?

There is no one-size-fits-all answer to this question as the best general liability insurance policy for your business will depend on a number of factors specific to your company. However, here are a few tips that could help you find the best policy for your needs:

- Work with an experienced insurance agent who specializes in electrical contractor insurance. They will be able to help you tailor a policy that meets the specific needs of your business.

- Get quotes from multiple insurance companies. This will allow you to compare rates and coverage options to find the best deal for you.

- Make sure to read the insurance company policy carefully before purchasing to make sure that you are getting the coverage you need.

- Review your policy regularly and update it as necessary to ensure that it continues to meet the needs of your business.

Top 6 GLI Providers for Electrical Contractors

Now that you know a bit more about electrician insurance, it’s time to actually start shopping for a policy. To help you get started, here are six well-respected providers of this type of insurance:

NEXT

NEXT specializes in over 1,300 professions and includes general liability coverage in its plan for electricians. GLI from NEXT is at $11 monthly for its lowest price and could cover up to $300,000 in damages per occurrence. Still, it would be best to get a quote from the company as it is fast and free.

They also offer savings for bundled policies and provide coverages recommended for electricians such as workers’ compensation insurance, commercial auto insurance, and tools & equipment insurance.

NEXT has customer service available through their live chat feature and their mobile app wherein clients can manage, update, or cancel their policy at any time. Whether you’re experienced or new to the electrical contracting business, NEXT has perks for you. Our full NEXT insurance review is right here.

Hiscox

Electrician insurance is only among the hundreds of small business insurance offered by Hiscox, an insurance provider that has been running since 1901. Because of their experience, they are used to traditional businesses such as carpenters, handymen, painters, and, of course, electricians.

Hiscox offers excellent customer service and tailored policies to cover the risks associated with your specific industry. GLI from Hiscox starts at $30 a month and settles costs resulting from bodily injury, property damage, as well as personal injury that may be associated with your business.

However, because of their name in the industry, premiums for electrician liability insurance from Hiscox may be pricier than others’, so it would be best for already-established businesses looking to develop a long-term relationship with their providers. For example, if your business operates a fleet of work vehicles, then Hiscox can provide a comprehensive commercial auto insurance policy.

Their team of agents is reachable via phone or post so this may be something to take note of if you prefer online channels. Discover even more benefits in our Hiscox insurance review.

Thimble

As an electrical contractor, your services may only be needed by the job, for an hour, or a few months. For this reason, Hiscox has recently partnered with Thimble for short-term electrical contractor liability insurance so you do not have to commit to a policy you have to pay for monthly.

Thimble electrician insurance would then be suited for side hustlers and you can manage your policy with them all through their mobile app. Additionally, they have a live chat feature available on their site for more urgent concerns. Read more about our most flexible provider in our Thimble insurance review breakdown.

SimplyBusiness

SimplyBusiness is a longstanding online small business insurance broker that offers general liability insurance for multiple professions including electricians starting at $22.50 a month.

“Just as a surge protector prevents a voltage spike”, SimplyBusiness writes that GLI prevents excessive costs from accidents that may pose serious harm to your electrical contracting business.

They protect anyone from the self-employed to already established LLCs and could be reached via phone. They are the provider for you if you look for experience in your providers who offer expertise in multiple industries.

Do keep in mind, however, that their offices are in the U.K. so if the location is something you consider then you would want to seek other providers based in the U.S. Learn more about this business insurance broker in our detailed Simply Business insurance review walkthrough.

InsuranceBee

Electrician insurance from InsuranceBee, a liability insurance company, starts at $25 a month. Take note that their electrician insurance is for those involved in interior work only and protects independent electrical contractors from accidents involving people and errors which may damage others’ properties.

InsuranceBee specializes in independent contractors so, if you are a bigger company, you may want to go with a different option. However, if you are running your business solo and need protection for your contracts, it would make sense to get insured by InsuranceBee and their agents. Find our in-depth InsuranceBee review here.

biBERK

biBERK is a direct insurance provider under the Berkshire Hathaway Insurance Group that is developed specifically for small businesses. Focused on state laws compliance and simplicity, they offer key insurance coverages including electrcian business insurance that will come in handy for electrical contractors whose employees are exposed to hazards such as electrical boxes and live wires.

GLI from biBERK starts at approximately $27.50 per month and is available in all 50 states except for four which are Washington, Wyoming, North Dakota, and Ohio. If you would like to get in touch with a representative from biBERK, you could do so via multiple channels including email, phone, or submitting a form. This biBERK insurance review will compare and contrast its product solutions.

The Bottom Line

Electrical contracting businesses face multiple risks given the nature of your operations. And while this could be prevented by proper training, equipment handling, and other precautionary measures, accidents still happen, and without the right plan, sparks could fly. Thankfully, we now know that electrician business insurance could help in these circumstances.

Over and above that, there are a lot of things to consider when shopping for electrician insurance policy for your business. By taking the time to understand what coverages you need and getting quotes from multiple providers, you can be sure to find the right business insurance for electrical contractors by the hour, day, or month at the best price.

For more help with your research, you can read our full guides on the mentioned insurance providers. Thank you for reading!