The Unexplored Potential of Liability Insurance in Dog Grooming

Last Updated on June 8, 2023

Concerned about potential liability threats impacting your dog grooming business? There’s no shortage of risks associated with this profession, but you can protect yourself with the right insurance.

Understanding the Risks in the Pet Grooming Industry

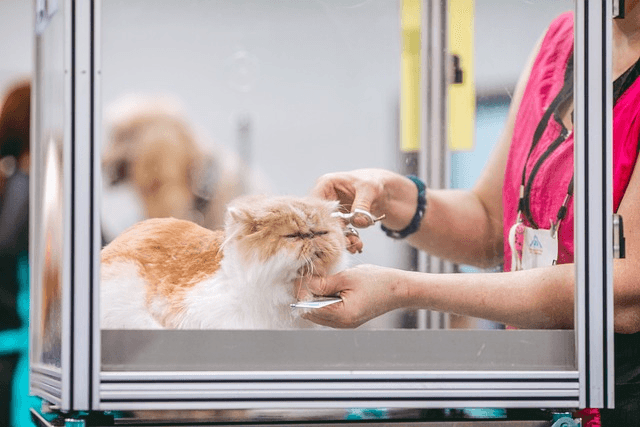

Welcome to the exciting world of pet grooming. The dog groomers among you spend your day among a flurry of fur, taking scruffy canines and transforming them into well-coiffed pets. But amidst the wagging tails and cheerful barks, there’s an unseen risk that is always present. Every bath, clip, and trim carries potential liabilities that could have a significant impact on your grooming business.

Just imagine a day where a dog in your care gets injured or an employee gets bitten. Or think about a time when a grooming tool malfunctions, resulting in harm to a pet or damage to your grooming van. In such cases, you need to be prepared to handle the fallout.

This is where the shield of liability coverage comes into play. With it, you can protect your small company from the financial burdens that can come from accidents, injuries, and mistakes.

Why Every Dog Groomer Needs Coverage

Whether you’re a mobile groomer traveling from home to home or a stationary groomer working in a bustling pet care center, a robust insurance policy is not just a good idea—it’s a necessity. The range of services you provide, from simple trims to extensive grooming, introduces numerous situations where things can go wrong.

Insurance safeguards your business in the face of these risks. It provides you with the coverage needed to deal with the costs of claims from unhappy customers or unfortunate incidents. Without this protective barrier, a single claim could cost your company a significant amount of money, potentially resulting in the loss of your hard-earned business.

A Closer Look at Coverage for Your Dog Grooming Business

The insurance landscape can seem like a maze. There are different types of policies and various coverages, each designed to protect your business in specific situations. As the owner, it’s crucial to understand these nuances to select the policy that will provide the most effective shield for your dog grooming venture.

General liability insurance, for example, helps cover the costs of claims if someone is injured on your business property or if you or your employees cause damage to a client’s property. It’s like a safety net that catches you when unexpected accidents occur.

Professional liability, on the other hand, offers coverage if you’re sued over the services you provide. If a client believes you were negligent in providing your grooming services, this policy can help pay for your defense costs and any potential settlement.

Commercial property insurance, meanwhile, covers the physical location of your establishment, whether it’s a storefront or your home if you run a home-based business. It helps cover damages to your building and the equipment inside it from events like fire or theft.

Understanding the different kinds of coverage available is key to ensuring your grooming business is protected from all angles.

Your Safeguard Against Costly Accidents and Injuries

Accidents and injuries can happen, no matter how cautious you are. For instance, a dog might get injured during grooming or a client might trip over a loose wire in your grooming salon. These incidents could lead to costly lawsuits.

Liability insurance acts as your safeguard in these situations. It covers the legal fees and potential payouts that could result from a lawsuit. Without this protection, you could find your company facing financial hardship or, worse, bankruptcy.

A good liability policy helps you navigate these storms, ensuring you can continue to thrive even when accidents occur.

Covering Your Employees

If your grooming business has employees, another important consideration is workers’ compensation insurance. This coverage is typically required by state law and protects your business if an employee gets injured on the job. It covers medical expenses and lost wages for the injured employee, and it can protect you from a potential lawsuit related to the injury.

With this policy in place, you can ensure that your team is protected, further fortifying your business against potential risks and liabilities.

Decoding Terms and Conditions

Just as it’s crucial to understand the different types of insurance, it’s also important to get familiar with policy terms and conditions. Reading and understanding these details can save your business from unexpected surprises down the line.

Most policies have a limit, which is the maximum amount the insurance company will pay for a claim. You’ll also find a deductible, the amount you’re responsible for paying before your insurance starts to pay. Understanding these and other terms is key to managing your liability policy effectively.

Real-world Scenarios Where Coverage Can Save the Day

The unexpected is a part of everyday life in the dog grooming biz. One moment, you’re expertly trimming a pup’s fur; the next, you could be dealing with an injured pet or damaged equipment.

Imagine a day when a usually placid Bulldog turns aggressive, biting one of your employees. The medical expenses and potential workers’ compensation claims can cost a hefty sum. Here, workers’ compensation coverage can protect both your employee and your business from the financial strain.

Or consider a scenario where you accidentally nick a pet while trimming their fur. The pet’s owner could file a claim against you, seeking compensation for veterinary bills. Your professional liability insurance would step in to handle these costs.

These are just a few of the countless scenarios where the right insurance policy can be the hero of the day, saving your livelihood from potentially crippling costs.

Tail-oring Your Liability Coverage to Your Specific Needs

Every pet grooming business is unique, and so are its insurance needs. Your coverage should align with the risks and needs specific to your establishment.

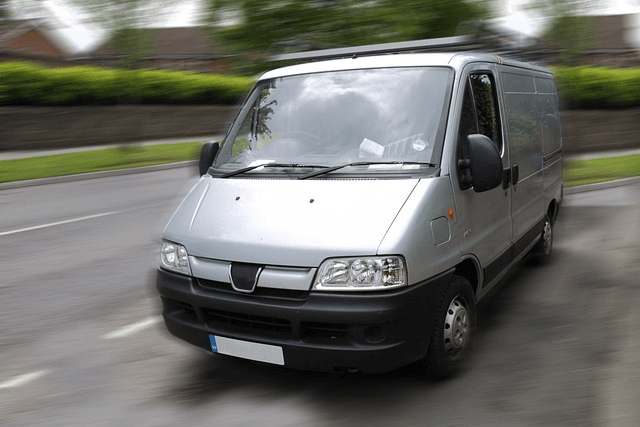

If you run a mobile grooming business, for example, you might need commercial auto insurance to cover your vehicle and any accidents that occur while you’re on the road. Or, if you’re offering pet boarding services in addition to grooming, you might need animal bailee coverage to protect pets in your custody.

Tailoring your liability policy ensures that you have protection in place for all the different scenarios that your business might face.

Understanding the Costs and Potential Savings of Coverage

Understanding the cost of insurance is just as important as understanding its benefits. The cost of your policy will depend on a variety of factors, including the size of your business, the number of employees, and the type of services you offer.

While insurance is an investment, it’s one that can offer substantial savings in the long run. The cost of a policy is often far less than the cost of a single claim. By investing in liability insurance, you’re investing in the longevity and stability of your dog grooming business.

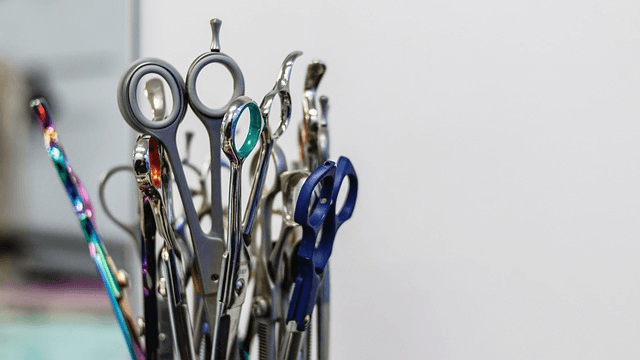

Ensuring Your Equipment is Covered Too

Just as important as insuring your dog grooming business against injuries and accidents is protecting your valuable equipment. Clippers, blow dryers, grooming tables, shears – these tools are essential to your operations. Commercial property insurance can help cover the costs of replacing or repairing equipment in the event of damage or theft, enabling you to quickly bounce back from such setbacks and continue serving your four-legged clients.

Navigating Auto Insurance Needs for Your Roaming Business

If your dog grooming business is on wheels, you’ll require an additional type of coverage: commercial auto insurance. This coverage protects your grooming van from damages due to accidents, theft, and other incidents. Given the unique challenges of a mobile operation, this coverage becomes a critical aspect of your insurance package.

Exploring Animal Bailee Coverage

When you’re responsible for another’s pet, you want to provide the best care possible. However, accidents can occur. Animal bailee coverage can help cover costs associated with injury, illness, or death of a pet in your care. This specialized coverage can provide peace of mind for both you and your clients.

How Liability Insurance Protects Your Rights

Liability insurance acts as a protective shield, ensuring your rights are safeguarded when dealing with claims and legal processes. It can help cover legal fees and payouts if you’re found liable for injury or property damage related to your services. More than a safety net, it’s a pillar of stability for your business amidst unpredictable circumstances.

The Simple Steps to Securing Your Insurance

Navigating the world of insurance may seem daunting, but it doesn’t have to be. There’s an array of resources available at your fingertips – from online insurance websites providing details of various coverages, to insurance agents ready to answer your phone queries. Armed with this information, you can gather quotes, compare options, and ultimately choose the liability coverage that best suits your needs.

Navigating the Sea of Insurance Providers

The right insurance provider can make all the difference in your experience with claims, coverage, and customer service. Therefore, it’s crucial to evaluate various factors such as the company’s reputation, their policy offerings, customer service, and financial stability before making a choice.

The Long-term Benefits of Your Insurance Investment

While it may seem like a considerable outlay, investing in comprehensive insurance coverage for your dog grooming business offers a range of long-term benefits. From financial security to peace of mind, a sound insurance plan can help you thrive amidst uncertainties, allowing you to focus on delivering top-quality grooming services.

Dealing with Claims and Legal Liability Procedures

Being equipped with an insurance policy means you’re ready even when the unthinkable happens. Claims and legal procedures can be overwhelming, but insurance can guide you through these situations, ensuring your business remains resilient in the face of adversity.

Moving Forward with Confidence and Protection in Your Dog Grooming Business

A well-crafted insurance plan isn’t just about managing risks, it’s about laying the groundwork for a thriving and resilient pet grooming business. With the right coverage, you can face the future with confidence, knowing you’re equipped to handle the liability challenges that may come your way.

In conclusion, insurance is not just an expense – it’s an investment in the longevity of your dog grooming business. By understanding your options and choosing wisely, you can ensure a safe environment for your furry clients, protect your assets, and operate with peace of mind.

Now it’s your turn to take the next step. Don’t wait until an incident occurs; start exploring your liability insurance options today. After all, every successful venture begins with a first step, and this could be yours towards safeguarding your future.

Suggested Reading

Mastering the Essentials of One Day Pet Grooming Insurance

Dodging Pitfalls: The Essential Role of Insurance in Mobile Dog Grooming

Protecting Your Pet Business: The Ins and Outs of Dog Grooming Coverage

Invisible Shield: The Game-Changing Role of Insurance in Your Dog Grooming Business